The ultimate guide to accounts receivable

Best-practice guidance on all things credit control and accounts receivable

Written for finance professionals, this comprehensive guide will help you optimise your accounts receivable processes, and put an end to late and inconsistent customer payments!

Download your free guide

This guide covers:

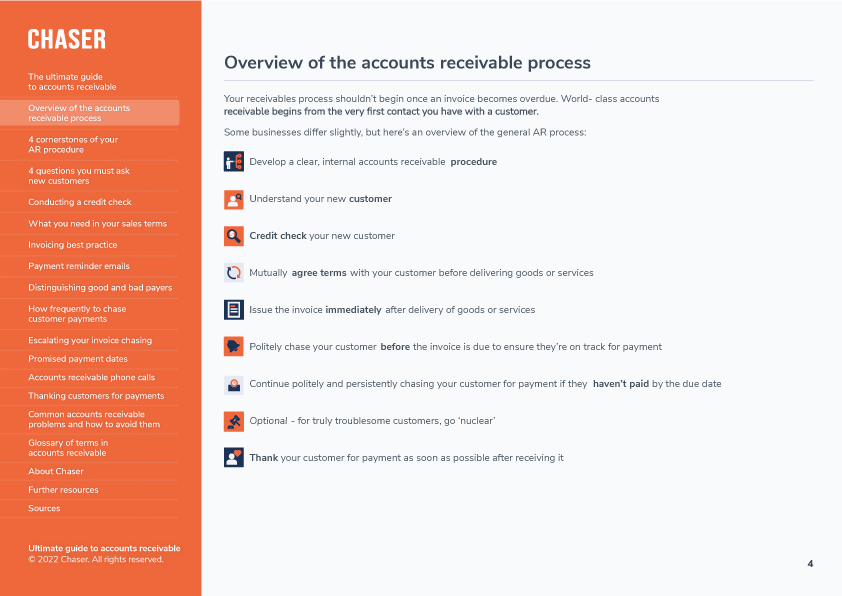

- Overview of the accounts receivable process

- 4 cornerstones of your AR procedure

- 4 questions you must ask new customers

- Conducting a credit check

- What you need in your sales terms

- Invoicing best practice

- Payment reminder emails

- Distinguishing good and bad payers

- How frequently to chase customer payments

- Escalating your invoice chasing

- Promised payment dates

- Accounts receivable phone calls

- Thanking customers for payments

- Common accounts receivable problems and how to avoid them

- Glossary of terms in accounts receivable

Take a sneak peek