“A very easy to use app, that's very clever at chasing debts. We've seen an improvement to debtor days almost immediately. ..the customer service and support Chaser offer is superb, can't praise them highly enough".

Private equity and venture capital firms accounts receivable software

As a private equity or venture capital firm, you should focus on identifying high-potential investments and driving growth, not chasing payments. Compelling accounts receivable management ensures you maintain a steady cash flow, which is crucial for funding new ventures and supporting portfolio companies.

Thousands of firms like yours are accelerating payments with credit management software

Start your risk-free trial

Start your free trial today and experience the power of automation software for accounts receivables management.

Effortlessly manage high transaction volumes

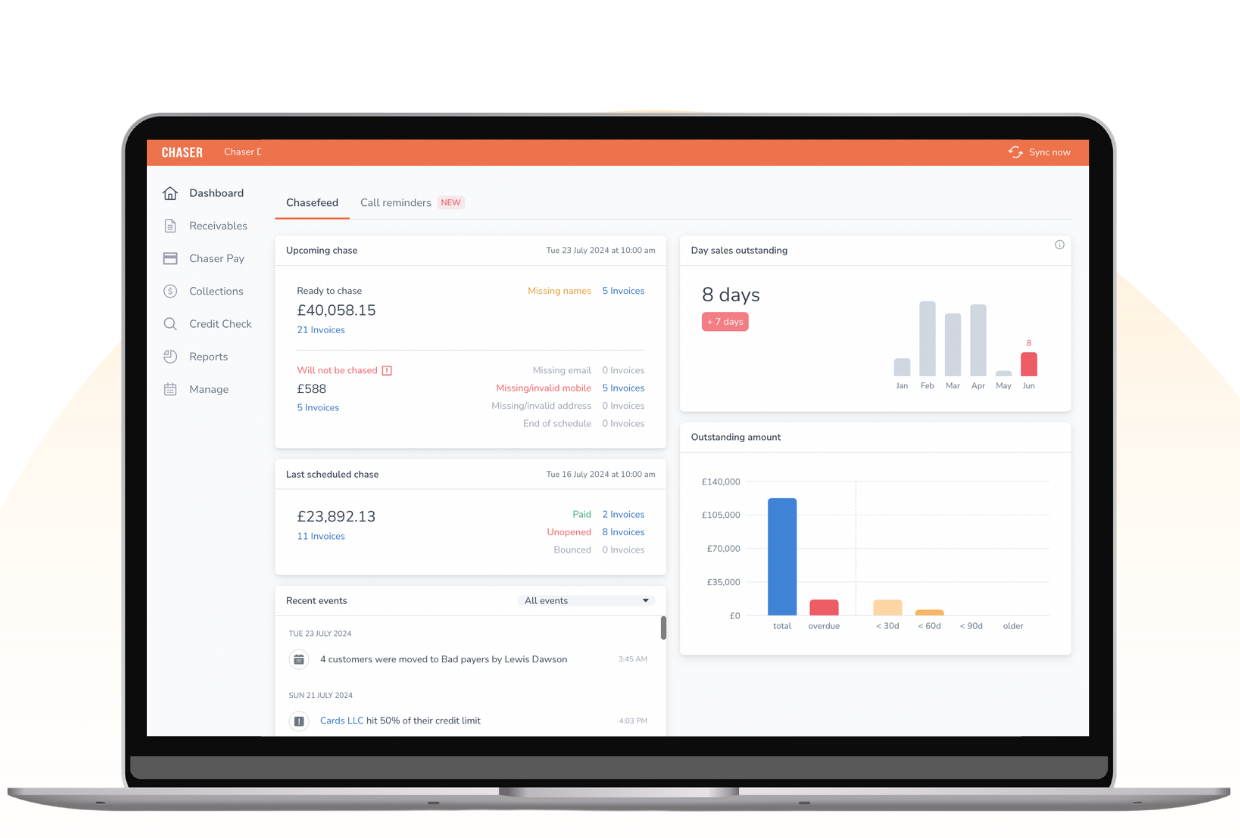

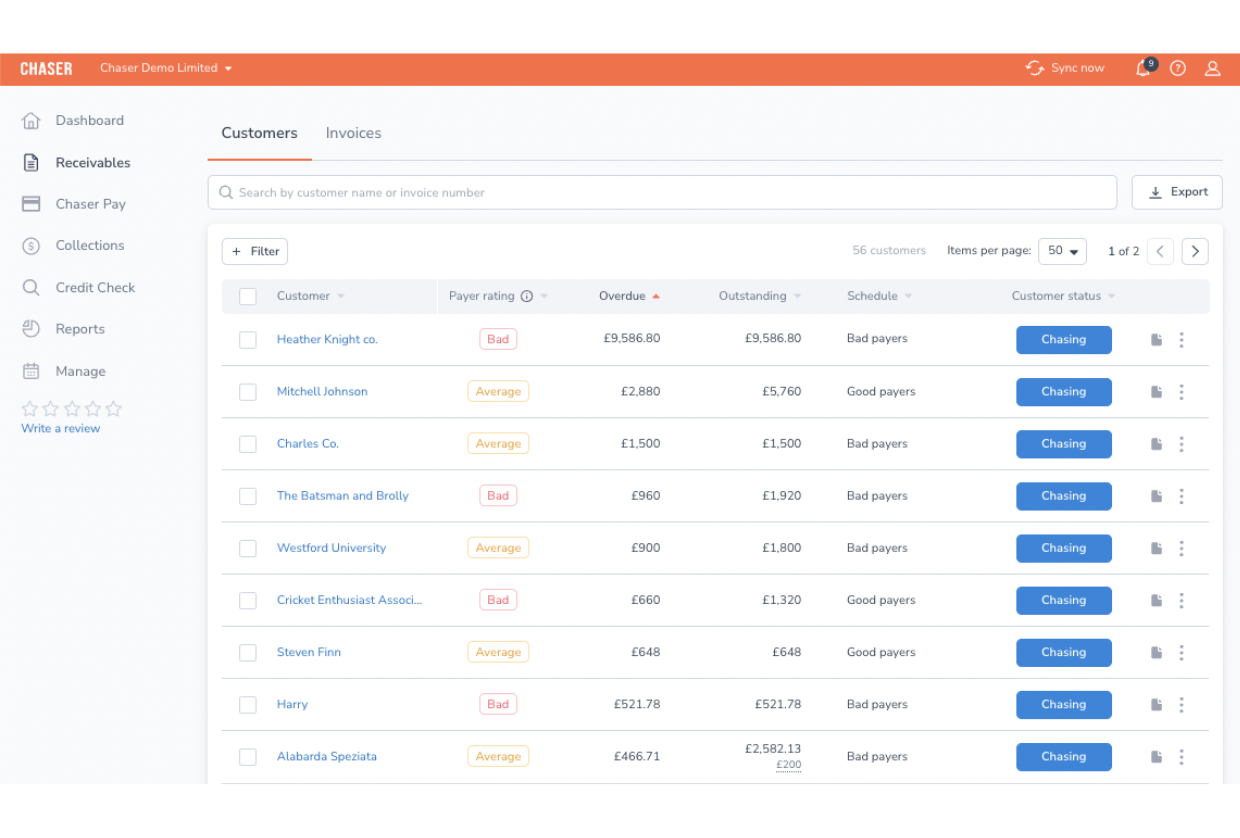

Private equity and venture capital firms handle a multitude of transactions daily, making efficient management crucial. Chaser simplifies this process by robustly handling high transaction volumes and ensuring meticulous tracking and follow-up of every outstanding invoice. It acts as an additional team member dedicated solely to maintaining your receivables, allowing your firm to confidently manage critical financial operations.Liberate your team from time constraints

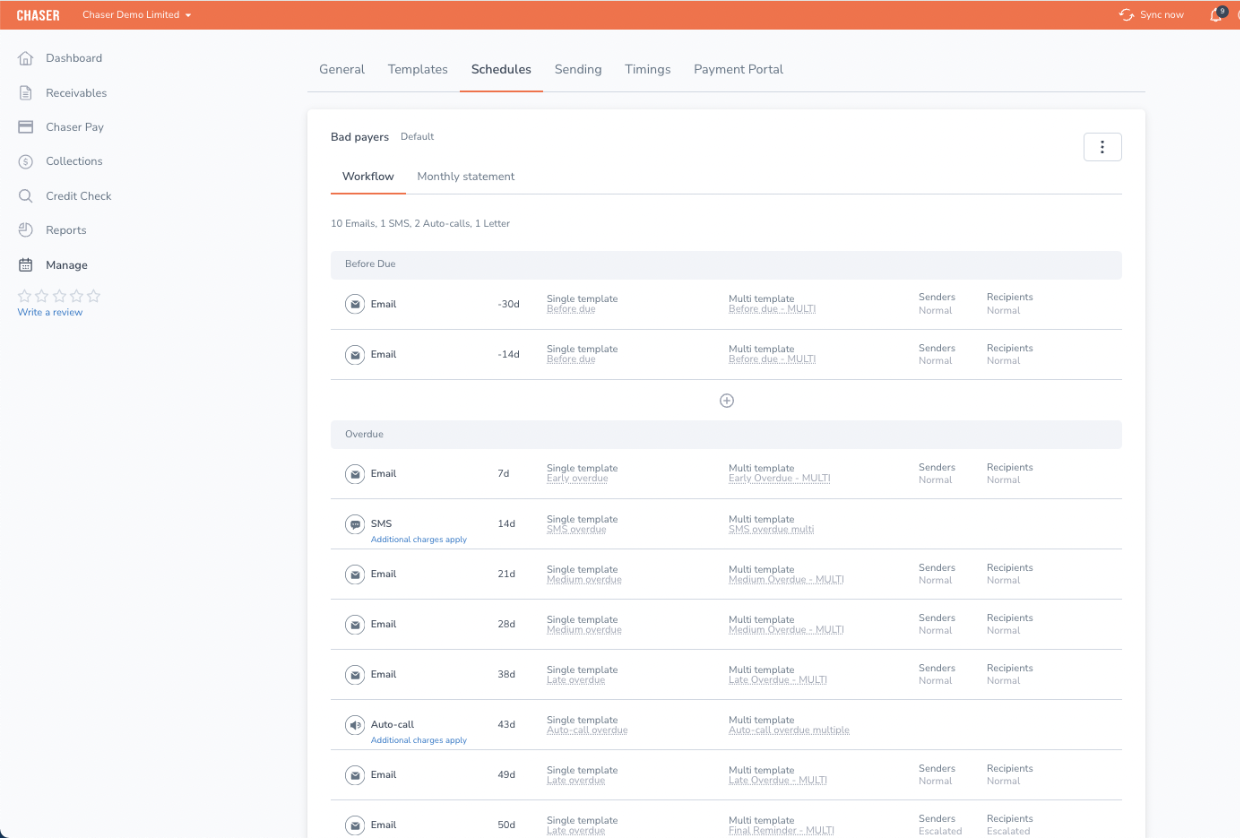

In the dynamic world of private equity and venture capital, manual management of accounts receivable can drain valuable time and resources. Chaser liberates your team from this burden by automating the entire follow-up process. Utilize Chaser to automate SMS and email payment reminders tailored to industry-specific payment schedules. This automation frees up time to focus on cultivating investor relations and pursuing strategic growth opportunities, and we are confident that Chaser is optimizing receivable management.

Facilitate swift client payments

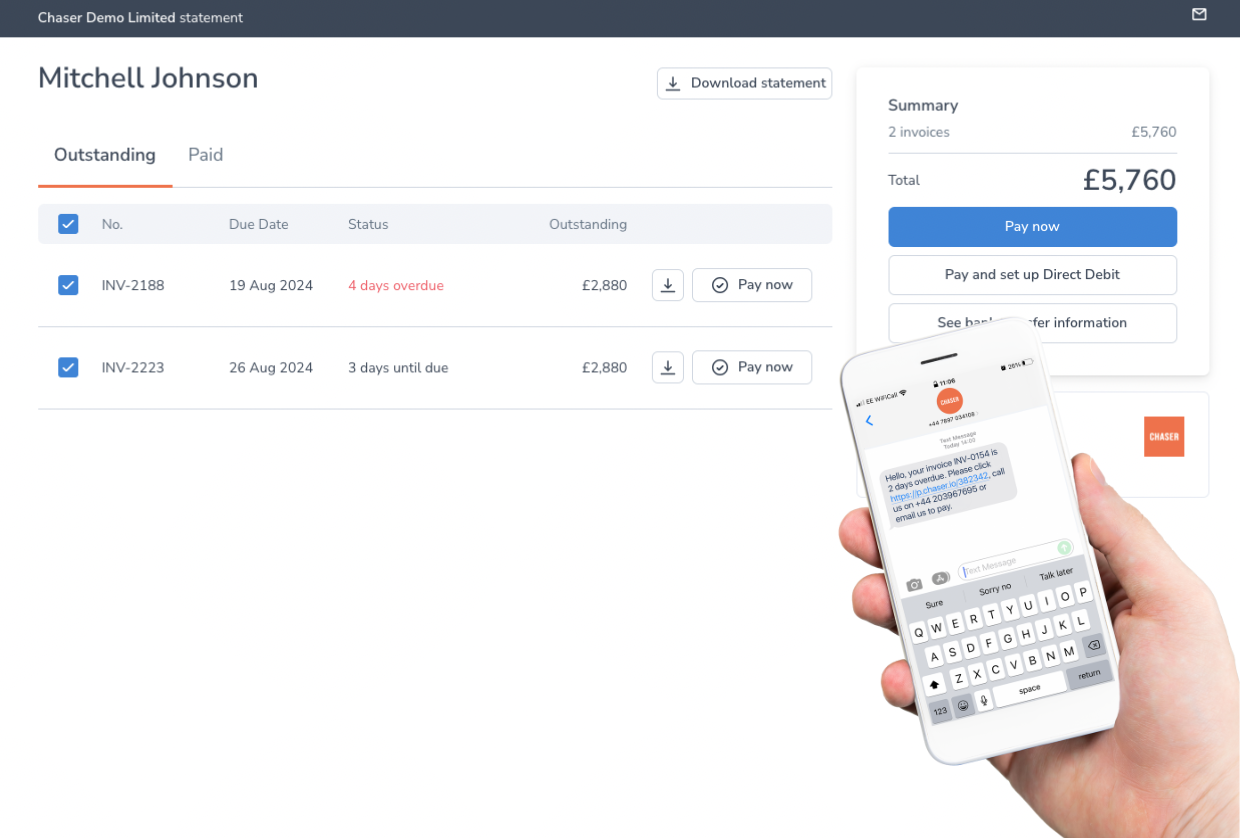

Chaser's Payment Portal feature streamlines the payment process for your investors and portfolio companies, offering a straightforward, few-clicks solution to settle invoices promptly. Embedded payment links in reminders prompt swift settlements and enhance client satisfaction with seamless transaction experiences. Supporting various payment methods, including bank transfers and Stripe, Chaser accommodates diverse investor preferences, ensuring steady cash flow management and reinforcing client trust.Seamlessly integrate with your tech stack

Chaser seamlessly integrates with leading accounting software used in private equity and venture capital firms via direct, API, or import integrations. This integration preserves workflow continuity and enhances operational efficiency from day one. Transitioning to Chaser's automated accounts receivable processes is not just simple—it's transformative, enabling firms to optimize financial operations and nurture strong investor relationships seamlessly.

Chaser connects seamlessly with your accounting system, ERP, or CRM, so you can minimize manual work and focus on delivering exceptional service

Get started quickly

Quickly learn how to use Chaser and start using the software effectively immediately, leading to better ROI on your software investment.

Work with the best

You want the best people managing your company's cash flow. With the help of our dedicated accounts receivables specialists, you can track your progress while working with best-in-class credit control software.

Improve cash flow

To run your company effectively, you need a healthy cash flow and payment predictability. Ensure your credit control process is structured, timely, and consistent with assistance from Chaser's credit control experts.

Save money

It's crucial to get the right start with any software for maximum effectiveness, to ensure you get the most value for your money - and most importantly that you get paid by your customers.

Maintain great customer relationships

Your accounts receivables specialist will contact customers on your behalf for up to two months, to remind them of outstanding invoices. This will clear out your backlog so that you can later maintain good credit control processes.

What Chaser users have to say

Stuart Hurst

Head Of Cloud Accounting, UHYSharon Pocock

Md & Principal Accountant, Kinder Pocock“This is such a good add-on. I truly believe that Chaser emails are sent with a little bit of magic. Even though I regularly used to send statements from Xero, the Chaser emails have had a far greater response, clients apologising for not paying sooner! It has definitely improved credit control, and the ‘thank you’ email when clients have paid is a lovely touch.”

Emma Fox

Founder & Md, Fresh Financials"Chaser has really changed the space. Several other apps have appeared in the market since Chaser - even Xero has its own invoice reminders. For us, though, Chaser is the one with the features we need. And at a great price, and with a great team supporting it, why would we ever change?"

The main benefits of using Chaser for your Private equity or Capital venture business

Automated reminders reduce the awkwardness of chasing payments, ensuring timely collections without straining relationships.

Eliminate manual AR tasks, allowing your team to concentrate on value-added activities and strategic decision-making.

Tailor automated communication to be considerate and aligned with your firm's professional image, ensuring respectful interactions with stakeholders.

Offer a variety of payment options, increasing the likelihood of timely payments and enhancing cash flow.

SPEAK TO AN EXPERT

A 15-minute call could save you 60+ hours a month on receivables

Over 10,000 users worldwide rely on Chaser to get paid faster, protect their cash flow and maintain good customer relationships.

See how businesses like yours improve their cash flow

Love Brands saved 15+ hours per week using Chaser

Love Brands is a multi-brand fashion distributor. For over 20 years, they have directly managed and acted as regional distributors for some of the biggest...

How TaxAssist got £20k of clients’ debts paid in 30-minutes with Chaser

TaxAssist Accountants work with a wide range of clients for whom they offer both personal and professional accounting...

How Glaze Digital focus on growing their agency instead of awkward payment...

Glaze Digital is a web and digital marketing agency based in Belfast, UK with national and international clients...