“A very easy to use app, that's very clever at chasing debts. We've seen an improvement to debtor days almost immediately. ..the customer service and support Chaser offer is superb, can't praise them highly enough".

Accounts receivable software for financial services

Maximize efficiency in payment collection while maintaining your clients' trust and confidence. Chaser's accounts receivable software automates your receivable process without sacrificing the personal touch essential to your services.

Financial services providers like yours are bringing their revenue in faster with Chaser's credit management software

Start your risk-free trial

Start your free trial today and experience the power of automation software for accounts receivables management.

Unlock capital that is tied up in outstanding receivables

In the competitive world of financial services, unlocking capital trapped in outstanding receivables is crucial for maintaining liquidity and funding operations. Chaser's automated receivables solution transforms this essential function by streamlining invoice chasing and payment collection, often draining extensive manual resources. With Chaser, your financial experts can now focus on delivering top-tier advice and services to your clients.Build robust client financial relationships

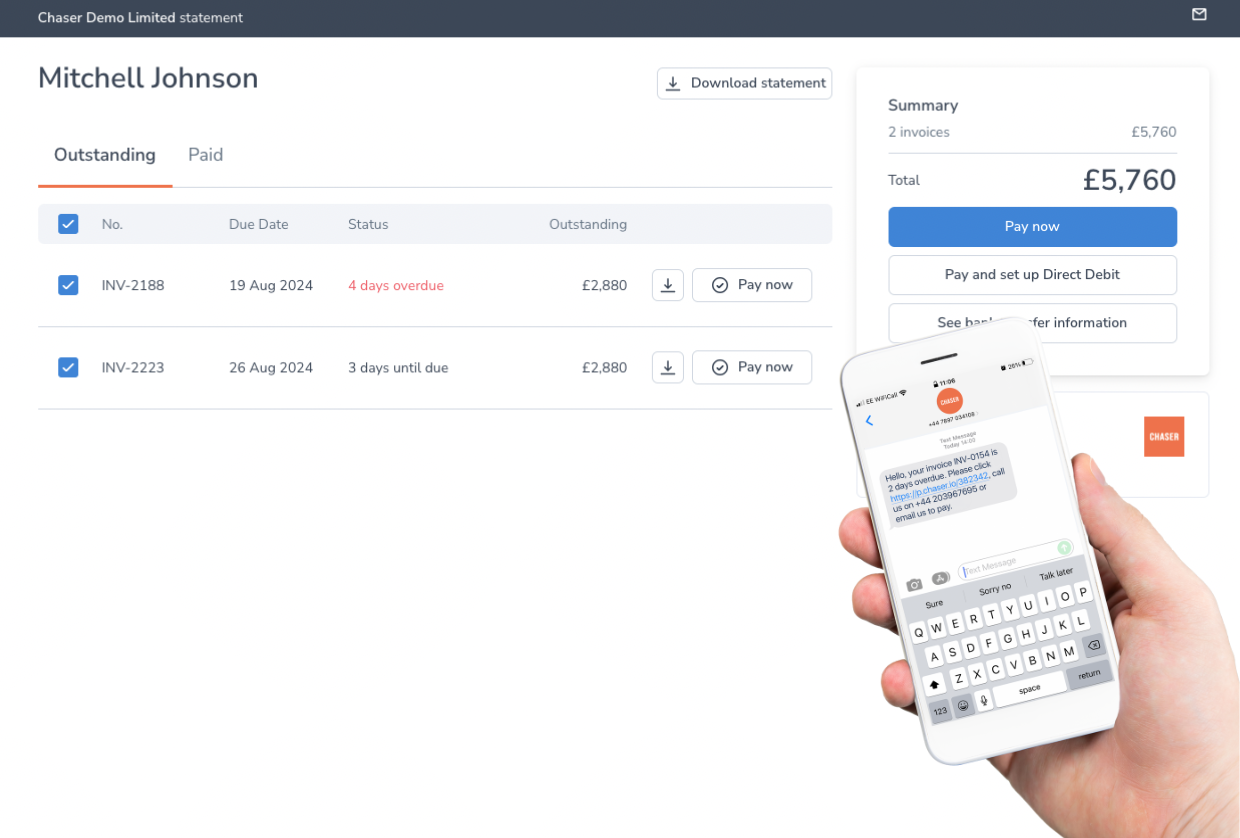

The financial services sector is built on client trust and confidence. Chaser's approach to payment reminders upholds this trust by communicating with clients professionally and respectfully. Each reminder is crafted to reflect the tone of your firm, helping you reinforce the value you place on each client relationship. By ensuring timely and well-received reminders, Chaser helps maintain the financial integrity and continuity essential to long-term client retention and satisfaction.

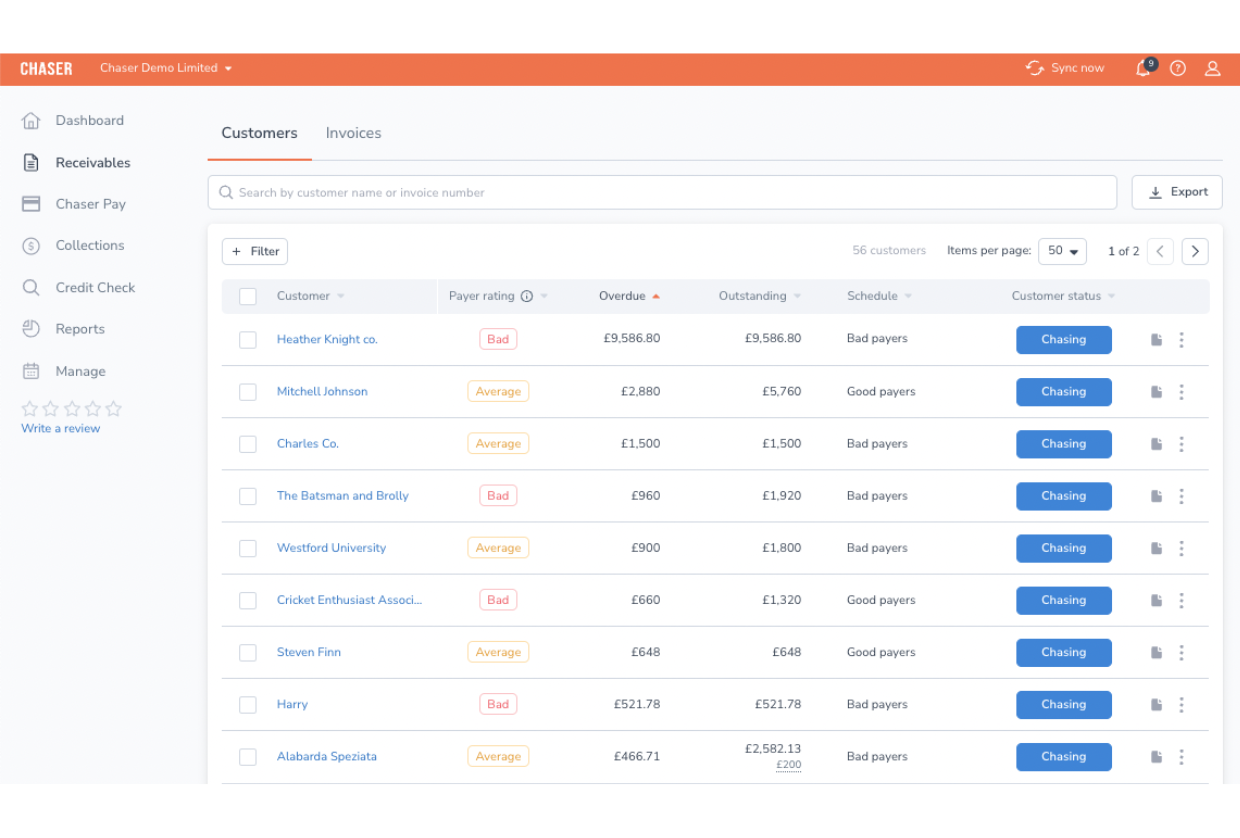

Full visibility, easy prioritization

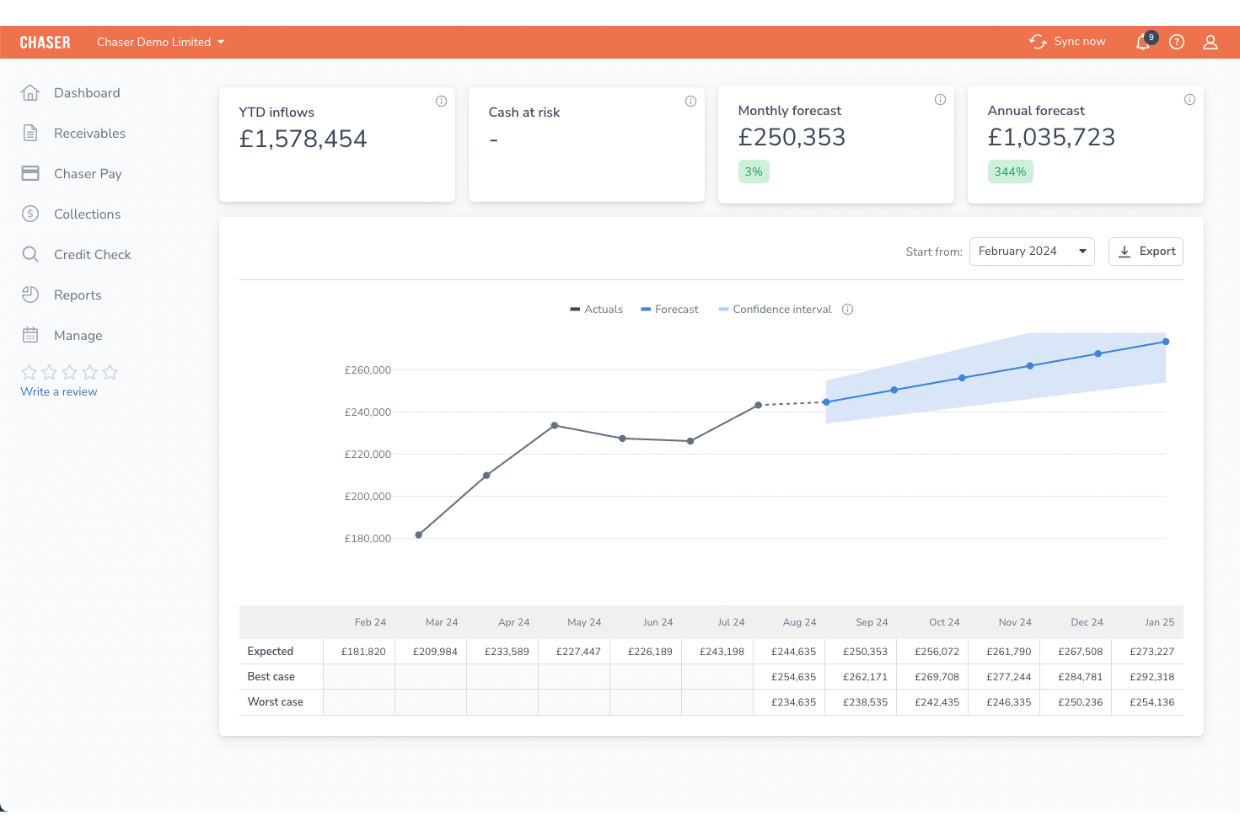

For financial service providers, having a detailed and immediate understanding of cash flow is essential for informed decision-making. Chaser delivers a comprehensive, real-time view of all accounts receivables, enabling your team to quickly identify which accounts need attention and allocate resources accordingly. This level of oversight allows for proactive financial management, ensuring that your firm can capitalize on opportunities for growth and address potential issues before they escalate.Make it as easy as possible for your clients to pay

In today's diverse financial landscape, clients expect a seamless payment experience that offers both convenience and choice. Chaser's platform responds to these expectations by supporting various payment methods, from direct bank transfers to credit card payments. This flexibility not only underscores your firm's commitment to accommodating client preferences but also streamlines the payment process, enhancing overall client satisfaction and strengthening the financial health of your clients and your practice.

Chaser connects seamlessly with your accounting system, ERP, or CRM, so you can minimize manual work and focus on delivering exceptional service

Get started quickly

Quickly learn how to use Chaser and start using the software effectively immediately, leading to better ROI on your software investment.

Work with the best

You want the best people managing your company's cash flow. With the help of our dedicated accounts receivables specialists, you can track your progress while working with best-in-class credit control software.

Improve cash flow

To run your company effectively, you need a healthy cash flow and payment predictability. Ensure your credit control process is structured, timely, and consistent with assistance from Chaser's credit control experts.

Save money

It's crucial to get the right start with any software for maximum effectiveness, to ensure you get the most value for your money - and most importantly that you get paid by your customers.

Maintain great customer relationships

Your accounts receivables specialist will contact customers on your behalf for up to two months, to remind them of outstanding invoices. This will clear out your backlog so that you can later maintain good credit control processes.

What Chaser users have to say

Stuart Hurst

Head Of Cloud Accounting, UHYSharon Pocock

Md & Principal Accountant, Kinder Pocock“This is such a good add-on. I truly believe that Chaser emails are sent with a little bit of magic. Even though I regularly used to send statements from Xero, the Chaser emails have had a far greater response, clients apologising for not paying sooner! It has definitely improved credit control, and the ‘thank you’ email when clients have paid is a lovely touch.”

Emma Fox

Founder & Md, Fresh Financials"Chaser has really changed the space. Several other apps have appeared in the market since Chaser - even Xero has its own invoice reminders. For us, though, Chaser is the one with the features we need. And at a great price, and with a great team supporting it, why would we ever change?"

Top four benefits of using Chaser at your financial services company

With Chaser's automated reminders, tailored for the financial services industry. Streamline your financial services receivables management to ensure timely payments and maintain client relations with precision and efficiency.

By automating the receivables process, Chaser reduces the operational burden on financial institutions. Automated payment reminders and follow-ups ensure timely collections, freeing resources for more strategic tasks.

Chaser's customizable communication templates and polite reminders help maintain positive client relationships while efficiently managing receivables. This approach minimizes the impact on client trust and satisfaction.

Chaser provides real-time tracking and detailed receivables reporting, enabling financial institutions to manage cash flow more effectively. This visibility helps make informed financial decisions and optimize liquidity.

SPEAK TO AN EXPERT

A 15-minute call could save you 60+ hours a month on receivables

Over 10,000 users worldwide rely on Chaser to get paid faster, protect their cash flow and maintain good customer relationships.

See how businesses like yours improve their cash flow

Love Brands saved 15+ hours per week using Chaser

Love Brands is a multi-brand fashion distributor. For over 20 years, they have directly managed and acted as regional distributors for some of the biggest...

How TaxAssist got £20k of clients’ debts paid in 30-minutes with Chaser

TaxAssist Accountants work with a wide range of clients for whom they offer both personal and professional accounting...

How Glaze Digital focus on growing their agency instead of awkward payment...

Glaze Digital is a web and digital marketing agency based in Belfast, UK with national and international clients...