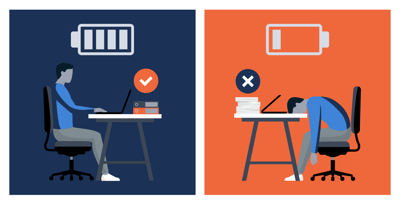

Should I use a carrot or a stick?

Anyone who’s ever been involved in debt collection knows the complexities and tripwires associated with getting people to pay back debt. Calling or messaging someone for the umpteenth time asking them to pay for products or services that they willingly purchased is uncomfortable - to say the least.

So, how can you persuade people to pay their bills? Are there creative ways to manage a potentially unpleasant situation to everyone’s benefit?

It turns out that there are some interesting facts about human nature that we can use to our advantage. Would you like to know more?

Debtors not paying on time?

The difference between can’t and won’t is a big one in the field of debt collection.

As service providers, we are not privy to our clients' personal information to the extent that we know for certain whether they are unwilling to pay, or simply unable.

Sadly, debt is a global issue, and the UK is no different. “The average loan per adult was £32,014 in December 2020. Based on personal debt in the UK, this is about 107.5% of the average yearly income.” (Source)

One year and an ongoing pandemic later, how are these numbers looking? How do you think they will impact your business when it comes to debt collection? Certainly, we’d all welcome some useful debt collection tips whether we’re dealing with delinquent clients or simply cash-strapped people.

How to collect money from clients who won't pay

Understanding the motivations behind people’s behaviour goes a long way towards timely payments and the reduction of bad debt. This will help us to understand why people do what they do, and how we can respond to get the most out of the interaction. Let’s look at a few examples.

Appeal to their values

A sense of responsibility and good values drive many customers to pay their bills on time. This intrinsic motivation is powerful and positive, and makes for great customers! It gives them a sense of well-being knowing that they are doing the right thing and fulfilling their commitments.

Identifying and encouraging this behaviour is a smart thing to do. Highlighting that they are, for example, ranked in the top 10% of your paying customers or dropping them an email expressing your sincere thanks for their ongoing commitment to their responsibilities, shines a torch on good behaviour. Who doesn’t love a pat on the back?

Apply logic and rationality

In this interconnected world, we are all concerned about our credit rating. Many institutions have used blacklisting or poor credit reviews as the proverbial stick in debt collection. Granted, this may work for some. However, have you considered reframing the perceived threat into a personal and rational decision to maintain a good credit record?

For example, instead of placing a note in bold at the bottom of an invoice stating that late payments will attract penalties and be handed over, we could add a reminder that prompt payments equal better credit rating and lower interest rates.

Another nudge in the right direction could be to appeal to the overarching goal of becoming debt-free. A follow-up email could say, “Congratulations! You have successfully reached 50% of your repayments and will be fully paid up in 6 months. Keep going!”

Use comparisons

An experiment conducted in 2010 by a division of the UK tax department showed how important context and comparisons are for us humans. They amended their standard reminder letter to read, “Nine out of ten people with a debt like yours, in your area, pay their tax on time. You are in the minority...”

This one sentence increased tax collections by 6% - perhaps not the biggest margin but when considered across millions of UK households, a noteworthy one.

Is this something you can add to your debt collection efforts?

Celebrate small wins

It’s easy to become demotivated and overwhelmed by debt, especially now when we’re all trying to pick up the financial pieces of our lives.

However, tracking small wins and incremental achievements is a method used in several aspects of life, such as when exercising, training for a hike, or reaching a desired weight. While this may not seem related to the payment of debt, it plays a surprisingly important part.

Some businesses make use of this psychological methodology by creating trackable payment plans, and offering recognition when these milestones are achieved. In thanking a client for their payment, an additional note celebrating 10 consecutive payments or a graph showing how far they’ve come in their payment journey, may just be the push that they need.

Offer various payment methods

All of us value choice and respond well when given it, and the same holds true when requesting payments from customers. Can you offer an online payment system which they can manage themselves? Would a card payment work better?

Removing potential hurdles is an excellent way to speed up payments while the reminders are fresh in our customers' minds. Therefore, offering multiple, easy payment options which give both autonomy and flexibility is a clear winner.

Be kind and understanding

We should never forget the emotional effects of debt.

An article discussing this notes, “With housing alone, a 2021 report by the Federal Reserve Bank of Philadelphia estimated that families owe about $11 billion in back rent. A study by the University of California put that figure at $20 billion.

“Whatever the cost, whatever the cause, debt wreaks emotional havoc on our psyche. Among the negative effects are low self-esteem and impaired cognitive functioning. That means you can’t learn, remember, be attentive or solve problems as well when you’re freaking out over your water bill.”

Whether they are unwilling or unable to pay, always be empathetic and kind.

Don’t undo all your hard work by destroying the motivation to pay. We humans are emotional beings, and some who have been harassed by debt collectors citing rude or threatening comments have intentionally chosen to withhold payment.

Of course, there comes a time when a customer slides into the realm of a liability and, really, who of us wants to work for free? When all reasonable means have been exhausted, it’s time to slough away the dead wood. Perhaps this type of customer isn’t one you want after all.

The question on how to get customers to pay on time then becomes, how can I recover my money and be done with this client?

"Don’t undo all your hard work by destroying the motivation to pay. We humans are emotional beings"

How do you ask for a payment professionally?

Public forums, social platforms, and review sites abound. Therefore, every business that wants to - well, stay in business - must pay close attention to its public image.

The first step is to set clearly defined and consistently enforced lending criteria, followed by a professional debt collection process. Maintaining appropriate debt collection etiquette is key.

Many customers react poorly to a phone call asking for payment in the first instance, so a series of messages or emails can be set up with friendly reminders. This quietly persistent method gives customers a feeling of autonomy and dignity, both of which matter more than we’d like to admit.

Call in the professionals

If you’ve exhausted both sticks and carrots when trying to persuade people to pay their bills, you’re not alone. It’s an exhausting business.

Our team at Chaser have mastered the art of debt collection and we’ve created systems that will make your life significantly easier! We’d like to invite you to enjoy a free trial with us, and let us show you how to streamline your systems and collect those outstanding balances.

Contact us here.