Credit control work is one of the most important but challenging aspects of any business. The work can be extremely demanding, and it's easy for employees to feel overwhelmed.

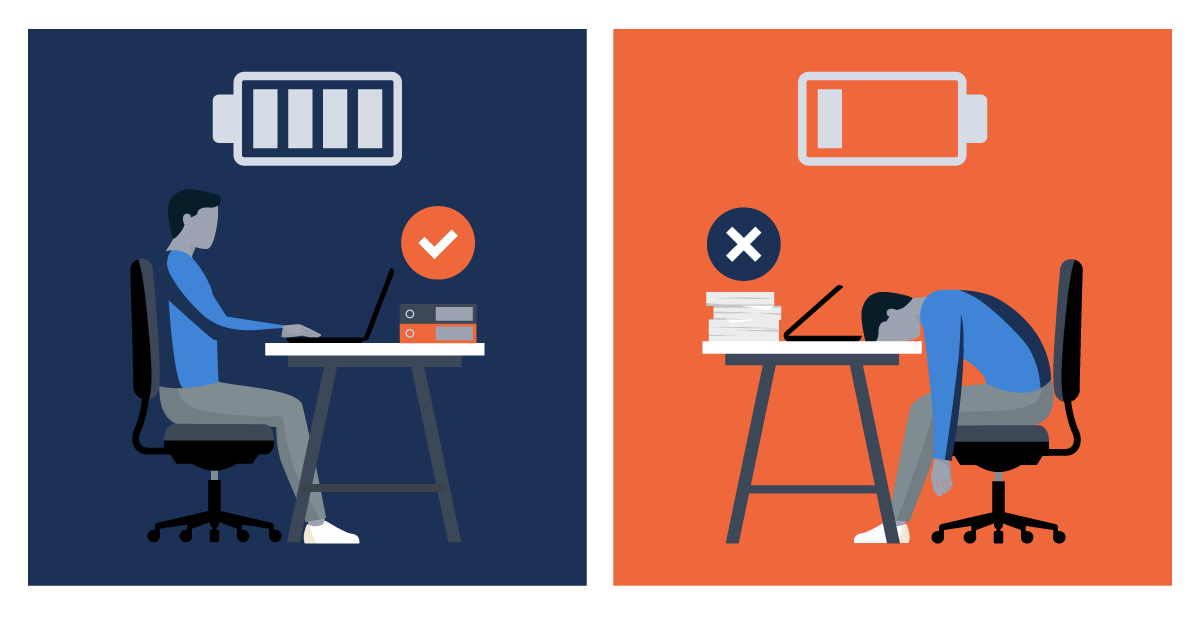

This can lead to poor mental health, which can have a negative impact on job performance and productivity.

In this blog post, we will discuss the dangers of poor mental health in credit control work and offer some tips for maintaining healthy mental wellbeing.

The lingering impact of the pandemic

The COVID-19 pandemic has had a significant impact on businesses all over the world. Many businesses have been forced to close their doors, and others have been struggling to stay afloat. This has put even more pressure on businesses, which has in turn increased the demand for credit control services.

Credit control teams are working harder than ever to keep up with the demand, and this can lead to burnout.

Burnout is a state of physical, mental, and emotional exhaustion that can occur when we feel overwhelmed or unable to meet the demands of our work.

When we're in a state of burnout, we may feel like we're unable to cope with the demands of our job, and this can lead to poor mental health.

Coupled with this is the new way in which most people are working. With the pandemic came the rise of remote working, and for many people, this has been a huge adjustment.

While there are many benefits to remote working, it can also be a challenge to stay motivated and connected when you're not in the same space as your colleagues.

This sense of isolation can compound the feelings of burnout, and it's important to be aware of this if you're working from home.

More trying times ahead

Unfortunately, while the impact of the pandemic is lessening, the economic instability it has caused is likely to continue for some time.

The pandemic is also not the only thing that is impacting the economy; the rise in oil prices, for example, has led to a huge rise in inflation, leading to a cost of living crisis in the UK.

Businesses are also experiencing a late payment crisis, with many struggling to pay their suppliers on time. This is having a knock-on effect on the economy as a whole and is likely to lead to more job losses in the coming months.

The conflict in Ukraine is also having an impact on the economy, increasing the prices of everything from wheat to fertiliser.

In short, the economy is facing a perfect storm of problems that are likely to cause immense difficulties for businesses and individuals alike in the coming months.

On the cutting edge

The unfortunate truth is that credit controllers and debt collectors are on the cutting edge of this crisis.

They are the ones who have to deal with angry and frustrated customers on a daily basis. They are the ones who have to break the news that their account is overdue. And They are the ones who have to put pressure on them to pay up.

It's a tough job, and it's one that can take its toll on your mental health. The stress of the job can lead to anxiety and depression, and there is also a risk of burnout.

That's why it's so important to look after your mental health if you work in credit control or debt collection.

As debt collection becomes an increasingly important part of the credit control process, it's crucial that collectors are able to look after their mental health.

Suffering in silence

The unfortunate fact is that mental health is still taboo in many workplaces. There is a stigma attached to mental illness, and people are often afraid to speak out about their problems for fear of being judged or seen as weak.

This means that many people who are struggling with their mental health suffer in silence. They don't seek help because they're afraid of what others will think, and this can lead to the situation getting worse.

Another factor that can contribute to poor mental health in credit control is the long hours and stressful environments that many collectors work in.

It's not uncommon for collectors to work 12-hour days, and the pressure to meet targets can be intense. This can lead to burnout, anxiety, and depression.

Chronic stress can also have a negative impact on physical health, and this can further compound the problem.

The bottom line is that poor mental health is a serious issue, and it should be taken seriously. The good news is that there are things that can be done to improve the situation.

Making changes to work culture

How we approach workplace mental health is changing. There is a growing recognition that mental health is just as important as physical health, and that it should be given the same level of attention.

The reality is that it benefits everyone when employees are healthy and happy. This includes the employer, who can avoid the cost of absenteeism, presenteeism, and staff turnover.

According to the CDC, depression causes an estimated 200 million lost workdays each year, costing US businesses $17-$44 billion.

There are a number of things that employers can do to create a healthier workplace environment. These include:

Promoting wellness: Employers should promote wellness in the workplace by providing information and resources on how to maintain good mental health. They should also create an environment that supports healthy lifestyle choices.

Encouraging openness: It is important for employers to encourage employees to be open about their mental health. This includes creating an open and supportive culture, as well as having policies and procedures in place to address mental health issues.

Providing support: Employers should provide support to employees who are struggling with their mental health. This can include access to counselling and employee assistance programs, as well as accommodations such as flexible work schedules or modified duties.

Promoting resiliency: Employers should promote resilience in the workplace by providing training and resources on how to manage stress and build resilience. They should also create a culture that supports and values employee wellbeing.

Setting realistic targets: One of the main sources of stress for collectors is unrealistic targets. If targets are too high, it puts unnecessary pressure on employees and can lead to burnout. It's important to set realistic targets that employees can actually achieve.

Providing access to therapy: One way to help employees manage stress is to provide access to therapy. This can be done by offering Employee Assistance Programs (EAPs) or through health insurance plans.

These are just some of the things that can be done to improve mental health in the credit control department. It's important to remember that credit control is a vital part of any business, and the people who work in this area are crucial to its success.

How credit controllers can proactively safeguard their mental health

Working in credit control can be a stressful job. There are often tight deadlines, high targets and difficult conversations with customers.

It's important to remember that credit control is a vital part of any business, and the people who work in this area are crucial to its success.

Here are some tips on how credit controllers can proactively safeguard their mental health:

- Make sure you take regular breaks away from your desk. Get up and walk around for a few minutes every hour. Physical exercise is also important, so try to get some exercise every day.

- Make sure you have a good support network around you. This could include family, friends, colleagues or a professional support service. Talk about how you're feeling with someone who will understand and can offer practical advice.

- Try to maintain a healthy lifestyle by eating well and getting enough sleep. This can be hard to do when you're under pressure, but it's important to try. Sleep debt can build up over time and lead to burnout.

- Take some time each day to do something that you enjoy, whether it's reading, listening to music or going for a walk.

- Stay connected with friends and family. Schedule regular catch-ups, either in person or online. Isolation can make problems seem worse than they are. Talk to someone if you're feeling stressed or overwhelmed. This could be a colleague, friend, family member or professional counsellor/therapist.

- Seek professional help if you're struggling to cope. A counsellor or therapist can offer support and guidance. If you're feeling overwhelmed or struggling to cope, don't hesitate to reach out for help. There are many services available to support people in credit control work. Don't suffer in silence - seek help if you need it.

Overcoming the biggest danger in credit control work

As the economic conditions worsen, credit control workers have never been more vital or under more pressure.

The demands of the job can take their toll on your mental health. It's important to be aware of the signs that you're struggling and to seek help if you need it. There is no shame in admitting that you need support.

By taking care of your mental health, you can be more effective in your work and better able to weather the storm.