Email is an incredibly effective tool for credit control. Here at Chaser, we’ve seen that approximately 90% of outstanding invoices can be successfully collected through email follow-ups alone.

As powerful as that is, a shocking number of Finance teams don’t keep their email sword sharpened, meaning drastically subpar success with their credit control. That’s why we’ve provided 4 of the most effective invoice reminder email templates to follow up on outstanding invoices to help you get paid faster while retaining good client relationships.

Read on for more insights or scroll down to the email templates.

Common issues when companies follow up on outstanding invoices

Writing invoice payment reminder emails and following up on your outstanding invoices from scratch can be time-consuming and complex. And this is a drain on your Finance team’s time. Even if you’ve used email templates to chase overdue invoices, they may not be having the desired effect. We understand that some customers reply venomously, ambiguously, or simply not at all. Then you have your clients who are constantly paying late no matter what.

Check out our guide on what to do when clients aren't paying for more details and expert tips.

Common outstanding invoice email aberrations include:

- an unfriendly tone

- the appearance of automation and lack of personal touch

- an aggressive or judgemental approach and tone

- overuse of the same email template/content

- and even chasing payments from the wrong person entirely

Get more insights into what can go wrong in our blog, 8 credit control mistakes you could be making.

With our tried and tested invoice payment email templates to follow up on outstanding invoices, these issues will be a thing of the past. All account managers and Finance team members should know how to write an email to customers to get invoices paid quickly, without coming across as rude. These template samples follow best practices and are the default for our Chaser users. Give them a try - you’ll be pleased with the results!

Note that anything inside the italicised [square brackets] is a placeholder that you should replace with the appropriate information for your specific overdue invoices.

What to do before an invoice is due

Before diving into the email templates, consider the key thing you need to focus on before an invoice is due: ensure the conditions are suitable for your customer to make payment. Outside of credit control best practices, like raising and issuing invoices as close as possible to the sale date, the only other task you need to undertake is politely inquiring and following up to check if everything is on track for the customer to make payment by the due date.

This ensures your invoice is fresh in their mind and harder to “forget” to pay - it also goes a long way in building and maintaining a great working relationship. The first of our best practice invoice payment reminder email templates is a polite initial email that sets the tone.

How to write a polite payment follow-up email

The objective of this first initial invoice payment reminder email here is relationship building, using polite methods for requesting payment via an invoice reminder. See our first best-practice email template below, which politely asks for an outstanding payment and reminds the customer of the invoice due date:

Subject: [Your business’ name]: invoice [invoice reference number]

Body:

Hi [Recipient’s first name]

I hope you are well.

I just wanted to drop you a quick note to remind you that [amount owed on invoice] in respect of our invoice [invoice reference number] is due for payment on [date due].

I would be really grateful if you could confirm that everything is on track for payment.

Best regards

[Sender’s first name]

Need help with reminding customers about multiple outstanding invoices? You can see how to chase multiple invoices in one email in our full guide of all 8 of the most effective email templates for getting invoices paid.

Why this initial polite invoice payment reminder email works

A clear and concise subject line works wonders. With most inboxes limiting the subject line to just a few words, it’s imperative to say as much as you can with as little text as possible. Couple this with considering how many emails your recipient receives per day. You’re fighting a battle to get your email noticed and actioned.

Our tests found the combination of your business name and the invoice reference number hits the sweet spot. It lets the recipient know precisely who’s communicating (in this case, your business’ name) and to what this email refers.

In the body of the email, a well-wishing opening line serves as a reminder that you're both fellow humans just trying to do their jobs. As a bonus, it’ll help lower any defensive guard they might have and help you achieve a mutually agreeable outcome.

The rest of the email is clear and concise, much like the subject line. Framing the inquiry as casual (here, “just wanted to drop you a quick note”) goes a long way to dial down the formality and diffuse any potential to be interpreted as harassing them about their outstanding payment. Remember to cover the below in your follow-up email:

- The amount outstanding

- The invoice reference number

- The due date

Finally, finish the email with a polite inquiry about the progress of invoice processing (here, “I would be really grateful”). This builds a friendly rapport with your customer and helps future invoices get paid quickly and easily.

Before sending the email, don’t forget to attach a copy of the invoice. This prevents things from getting held up by claims of “oh, I never received that invoice…”, should they arise. Of course, if you’re emailing them about multiple outstanding invoices, attach a customer statement to your payment follow-ups.

If you’re chasing new customers for payments, our Ultimate Guide to Accounts Receivable outlines the questions to ask new customers. Download the guide to learn more.

Invoice payment reminder email template 2: When an invoice is early overdue

In the early days after an invoice is overdue, you no longer want to politely nudge your customer to see if payment is on track. You should still be polite, of course, but your goal is to get a payment date agreed upon as soon as possible.

The objective here is to positively but firmly communicate that there are outstanding payments due. The below email template is our proven method of getting overdue invoices paid:

Subject: [Your business’ name]: invoice [invoice reference number]

Body:

Hi [Recipient’s first name]

I hope you are well.

We have yet to receive payment from yourselves of [amount owed on invoice] in respect of our invoice [invoice reference number] which was due for payment on [date due].

I would be really grateful if you could let me know when we can expect to receive payment.

Best regards

[Sender’s first name]

Why this early overdue invoice payment reminder email works

This second invoice payment reminder email template follows many of the principles outlined in the first one. One key difference is that you’ll ask when payment can be expected. This puts the (light) pressure on them to reply, as you’ve asked for a piece of information rather than just expressing that the invoice is unpaid. It encourages them to define a timeframe within which they will pay, creating another promise (beyond the original invoice) that they should be inclined not to break to avoid gaining a reputation for being unreliable.

Again, remember to attach a copy of the invoice. We also recommend a version of this email to be sent once every 1-2 weeks to project credit control competence to your customer without overly harassing them.

Invoice payment reminder email template 3: A follow-up email for late overdue payments

If you’ve chased a customer repeatedly for an overdue unpaid invoice without any luck, it’s time to change your accounts receivable tactics.

If customer invoices are regularly becoming late, it may be worthwhile distinguishing your business' good and bad payers. Follow-ups can be adjusted and tailored accordingly for each group to maximise your chance of prompt payments.

This next best practice invoice payment reminder email template strives to achieve the goal of getting a payment date agreed upon but, in this case, you let the customer know that late payments are not okay and add an element of urgency to payment reminders. Take a look:

Subject: [Your business’ name]: invoice [invoice reference number] OVERDUE

Body:

Hi [Recipient’s first name]

I hope you are well.

We have yet to receive payment from yourselves of [amount owed on invoice] in respect of our invoice [invoice reference number] which was due for payment on [date due].

This invoice is now [number of days overdue] days overdue and is becoming really problematic for us. Please could you let us know about when payment will be made as a matter of urgency.

Best regards

[Sender’s first name]

How to follow up on overdue invoices in a professional manner

This email template displays how to follow up on overdue invoices in a professional manner while making clear the urgency of the payment and the impact of it being overdue on the business.

This still shares the core principles of the previous invoice payment reminder emails - clearness, conciseness and politeness - but lets the customer know that late payment is not okay. It’s achieved with the line describing the late payment as “becoming really problematic for us.” You tap into your customer’s guilt about paying late without being aggressive. Doing the latter will only put them on the defensive and won’t help you achieve a mutually agreeable outcome, and it could sour the relationship.

The element of urgency is spelt out in the body with the line, “as a matter of urgency.” And it’s made clear with “OVERDUE” in the subject line.

As ever, attach a copy of the invoice, including a customer statement if you’re emailing about multiple invoices.

Invoice payment reminder email template 4: A thank-you email when an invoice is paid

Whether it was early, on time or two weeks late, when a customer pays an invoice, you should be sending them “thanks for paying” emails. The impact of a thank-you email can only be positive. They’ll either feel guilty about their late payment from your polite handling of it, endeavouring to pay earlier in future, or they’ll appreciate you recognising them paying promptly. This reinforces the relationship and ensures future payments remain timely.

We recommend the following email template for thanking your customers for paying their invoice/s:

Subject: [Your business’ name]: invoice [invoice reference number]

Body:

Hi [Recipient’s first name]

I just wanted to drop you a quick note to let you know that we have received your recent payment in respect of invoice [invoice reference number]. Thank you very much. We really appreciate it.

Thanks

[Sender’s first name]

Why a thank-you email for successful payments is so important

The objective of this thank-you email is relationship-building and encouraging positive behaviour by appreciating clients, while also being firm. As with the invoice payment reminder email templates, the thank-you email template follows many of the same core principles, as mentioned previously.

For more information, we’ve got a handy blog on how to make the most of invoice payment thank-you emails.

Summary

This series of invoice payment reminder email templates and their natural but professional tone go a long way to building a great relationship with your customers and helping you get paid sooner in future. For our full set of templates, tried and tested over our 8 years of invoice chasing and having helped businesses recover over $10bn in unpaid invoices, you can access all 8 of our most effective email templates for getting invoices paid for free.

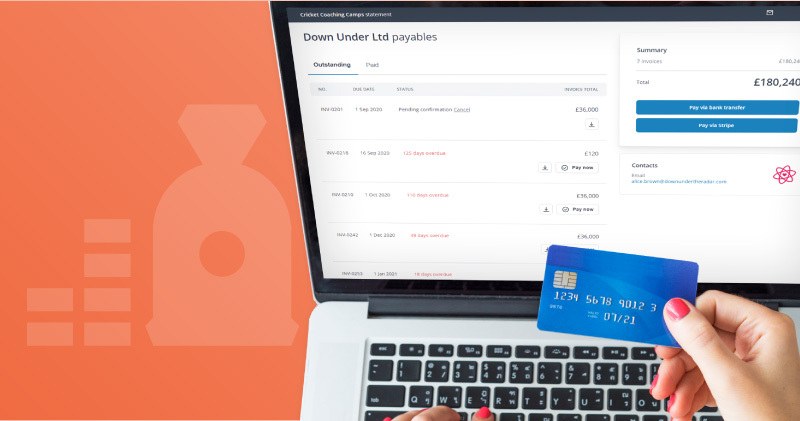

Optimising your credit control capabilities with Chaser

For best practice guidance on how to optimise your business’ credit control function, why not check out our ultimate guide to accounts receivables? These guidelines cover everything you need to know, from the fundamental cornerstones of your AR procedure (when, how and why) and conduct credit checks to how to distinguish good and bad payers.

Also, learn about what Chaser does. Chaser customers get paid faster. We offer a complete accounts receivables and invoice reminder solution, which can be easily integrated into your existing accounting system. Browse the Chaser integrations to see which systems you can sync with, including leading software providers like Xero, QuickBooks, Sage, and many more.