Topic: Credit control & accounts receivables (7)

What is trade receivable? | Definition and importance | Chaser

Trade receivables is a term used to describe the amount of money owed by one company to another. It is the...

The role of technology in accounts receivable: Trends, tools, and Chaser

The ongoing late payment crisis is one of the largest and most prevalent threats to any modern business....

What is the best invoice wording for immediate payment? | Chaser

Building customer relations takes time, no small amount of effort, and consistently excellent products and...

When and how to ask for partial payments on invoices | Chaser

According to a recent study from Barclays, 57% of SMEs are “currently waiting on money which is tied up in...

.jpg)

8 credit control strategies that will boost your cash flow

Are you looking for effective but simple-to-implement credit control strategies to help you boost cash flow?...

10 tips to draft an accounts receivable policy for a small business | Chaser

If you're running a small business but spend every month stressing about your cash flow, then it's probably...

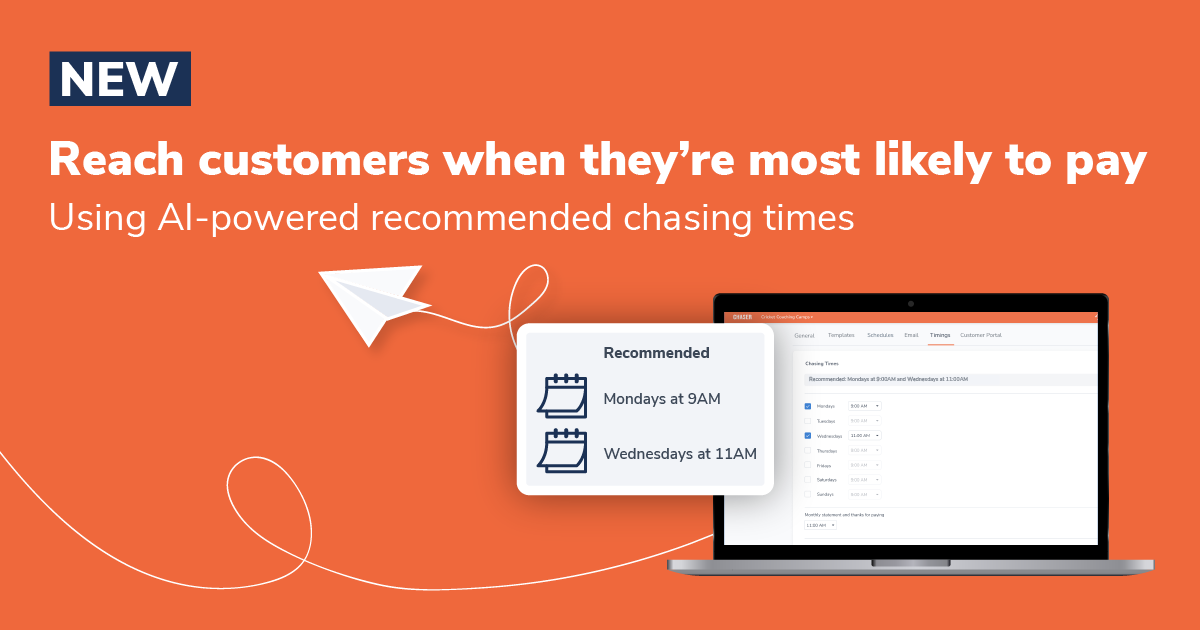

Reach customers when they're most likely to pay: recommended chasing times

Did you know that 50% of businesses spend more than four hours per week on accounts receivables tasks? This...

.jpg)

Net cash flow | Definition and calculation | Chaser

A business's net cash flow (NCF) is an indicator of its financial health over a specific period of time....

What does remit payment mean in B2B invoice payments? | Chaser

Payment remittance is the process of transferring money from a payer to a payee or one person to another...

.png)

10 accounts receivable KPIs you should track (+ how to improve them)

Your company is booming, sales are up, and you're feeling pretty good. But then you look at your bank...

.jpg)

5 proactive credit control strategies to get invoices paid on time

Businesses of all scales are threatened by the scale of the current late payment crisis, and repeated...

Collection call script: Effective international debt recovery guide

Navigating debt collection is tough. Navigating it across the UK, US, and Australia? It's a minefield of...