Topic: Credit control & accounts receivables (6)

10 best practices to improve your accounts receivable process | Chaser

We've all had that one friend who borrows money and assures us that he's going to pay as soon as the cash...

Subject lines for collections emails: what to include, what to avoid

Collections can be among the most challenging and frustrating aspects of running a business. It can be...

Overcoming challenges in credit control: Strategies for common pain points

Credit control is the process of managing a company's outstanding debts and ensuring that customers pay their...

Managing seasonal fluctuations in your cash flow

Seasonal fluctuations in cash flow are a normal part of business, caused by variations in demand, increased...

What is trade receivable? | Definition and importance | Chaser

Trade receivables is a term used to describe the amount of money owed by one company to another. It is the...

The role of technology in accounts receivable: Trends, tools, and Chaser

The ongoing late payment crisis is one of the largest and most prevalent threats to any modern business....

What is the best invoice wording for immediate payment? | Chaser

Building customer relations takes time, no small amount of effort, and consistently excellent products and...

When and how to ask for partial payments on invoices | Chaser

According to a recent study from Barclays, 57% of SMEs are “currently waiting on money which is tied up in...

8 credit control strategies that will boost your cash flow

Are you looking for effective but simple-to-implement credit control strategies to help you boost cash flow?...

10 tips to draft an accounts receivable policy for a small business | Chaser

If you're running a small business but spend every month stressing about your cash flow, then it's probably...

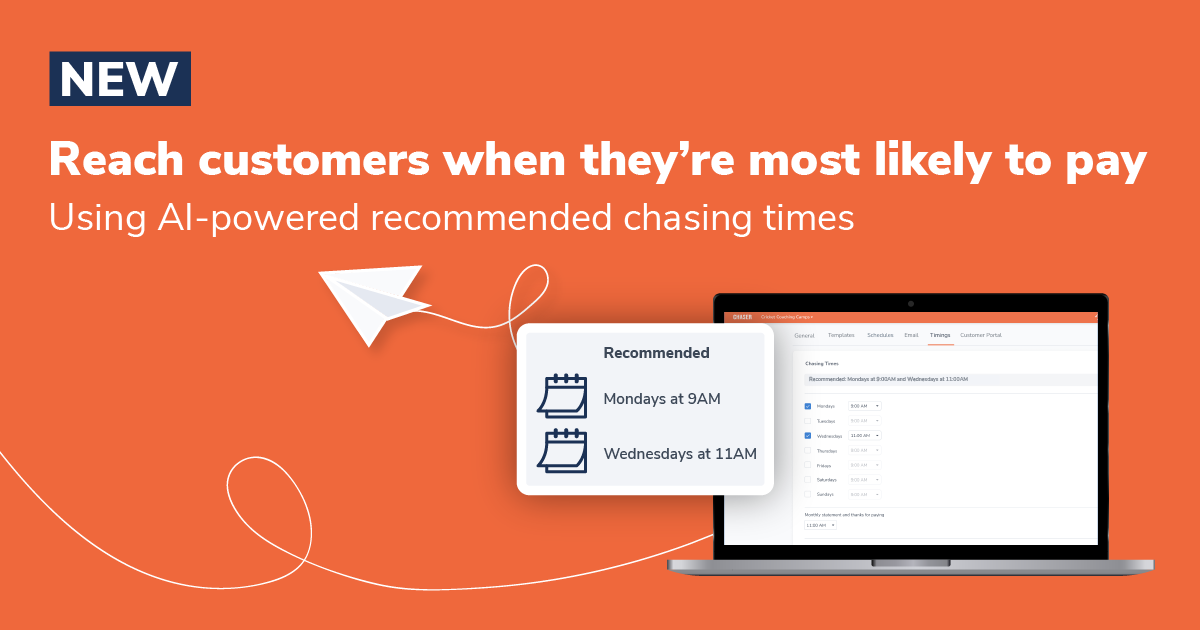

Reach customers when they're most likely to pay: recommended chasing times

Did you know that 50% of businesses spend more than four hours per week on accounts receivables tasks? This...

Net cash flow | Definition and calculation | Chaser

A business's net cash flow (NCF) is an indicator of its financial health over a specific period of time....