Topic: Credit control & accounts receivables (5)

When accounts receivable go wrong: What to do | Chaser

In the intricate blueprint of business finance, accounts receivable is as crucial as it is complex. It’s the...

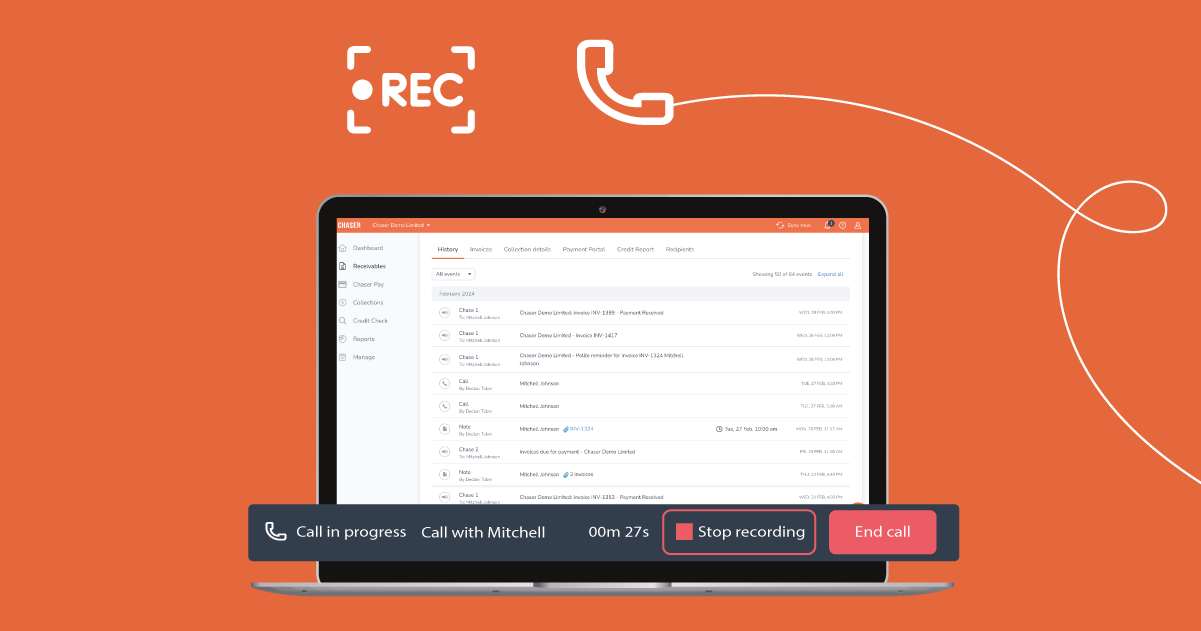

Introducing Call recording: How and why to record debtor phone calls

You can now record your debtor phone calls in Chaser. Easily keep track of payment conversations with your...

.jpg)

The future of payment terms: Flexibility vs. standardization

In an age where customer preferences and business dynamics are shifting faster than ever, payment terms have...

.jpg)

Negotiating with debtors: Best practices for amicable solutions

In business operations' labyrinth, debt negotiation is inevitable. It is crucial in managing financial...

What is creditworthiness and why does it matter in accounts receivable? | Chaser

For those responsible for managing the cash flow of a business, be it a bustling startup or an established...

.jpg)

How to improve customer experience with AR management systems

In today's highly competitive business landscape, customer experience has emerged as one of the most...

.png)

What is bad debt? | Chaser

In 2022, SMEs (small and medium enterprises) in the UK wrote off £5.8 billion in bad debt alone!According to...

.jpg)

Utilizing data analytics for enhanced receivables insight | Chaser

Data analytics has been gaining significant traction in recent years as companies across industries start to...

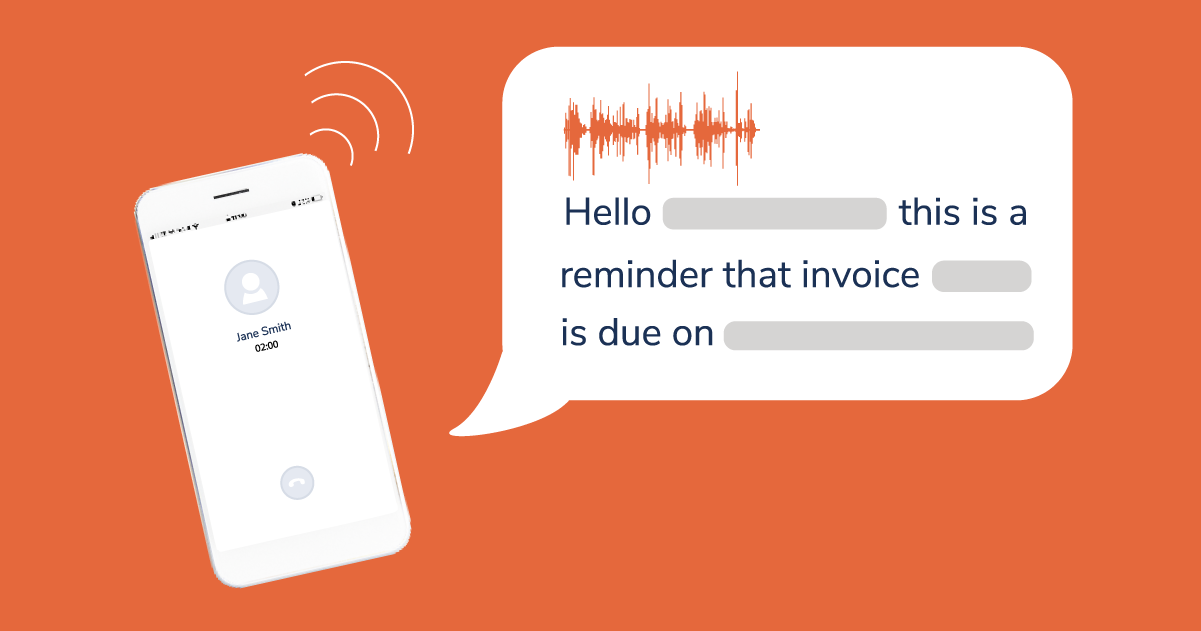

Reduce manual intervention when chasing late payments using Auto-call

Phone calls are a cornerstone of the credit management processes for many businesses. 61% of businesses list...

How can Chat GPT help accounts receivables managers and credit controllers

Accounts Receivable (AR) and credit control are essential function in any business. This involves managing...

The overlooked link between customer satisfaction and timely payments

Cash flow problems pose a serious threat to small to medium-sized enterprises (SMEs). Indeed, research shows...

.jpg)

The psychology of paying: Understanding customer payment behaviors | Chaser

In the ever-evolving landscape of consumer behaviors, one of the most dynamic aspects is how people choose to...