Topic: Credit control & accounts receivables (4)

What's the difference between a sales invoice and a purchase invoice? | Chaser

Every business owner knows that keeping your finances in check means getting your paperwork right, especially...

10 skills every credit management professional should have | Chaser

Chasing payments is nobody's favorite part of running a business. But when cash flow runs dry, companies can...

Master chasing schedules in Chaser: A friendly guide | Chaser

Keeping cash flow healthy is crucial for any business, and Chaser offers a powerful tool to help automate and...

5 signs you’re waiting too long to deal with late payments | Chaser

No one wants to wait to get paid. Delays cost you money and growth opportunities. Yet, you also need to be...

Send automated payment reminder letters to your debtors in the post

Have you ever experienced a debtor who ignores your emails, you can’t reach them over the phone, and despite...

Tackle late payments with cutting-edge receivable solutions | Chaser

Late payments are one of the biggest challenges to steady cash flow and predictable revenue for businesses....

Streamline your accounts receivable: Best practices for healthcare providers

Healthcare revenue cycle management is a vital component of your business. Without predictable income, you...

Leveraging accounts receivable for business growth | Chaser

Accounts receivable is a key component for every business, but not all have the resources or patience to...

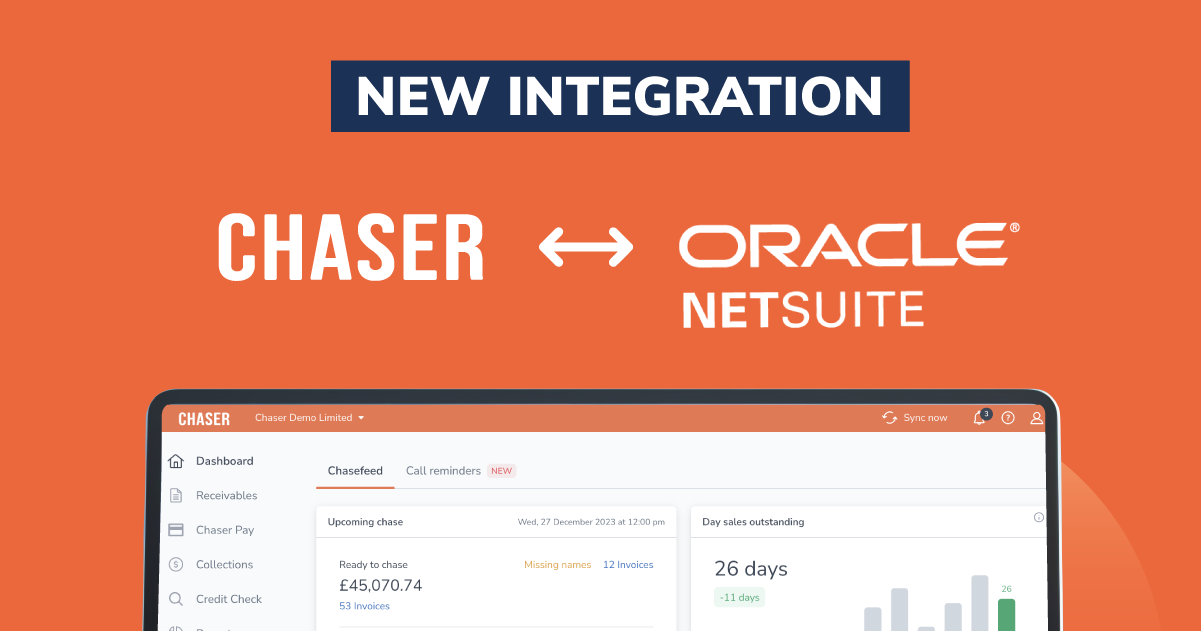

NetSuite users can automate invoice chasing and reduce late payments

Chaser has launched a new integration with Oracle NetSuite. This new integration allows NetSuite users to...

How to optimize accounts receivables for Oracle NetSuite & Oracle ERP

Accounts receivable management can be a long-winded and costly process. This article will show you how to...

Eliminate manual payment chasing with Chaser and Business Central

Business Central users can access a new, seamless integration with Chaser, making it even easier to eliminate...

How to effectively negotiate payment terms with your customers

The ability to negotiate accounts receivable is critical for the survival and prosperity of your business....