Topic: Credit control & accounts receivables (17)

A guide to setting credit limits for business to business payments

Offering your customers the option of lines of credit as a payment method is a great way of opening up new...

The shocking impact late payments have on productivity

The shocking impact of late payments on small businesses, their staff and their owners goes well beyond...

Supercharge your receivables with digital payments

Cash flow is the lifeblood of your business and payment delays can cause liquidity issues that can threaten...

Chaser releases a new payment plan feature

This month, Chaser released a payment plan feature that allows users to create customised repayment plans and

How to track invoices and payments | Chaser

Implementing the kind of credit control that keeps your debtor days to a minimum and gets you paid faster is...

How to avoid difficult conversations with clients on overdue invoices

The impact of late payments on UK businesses is staggering.

Effective (and friendly) ways to handle invoice and payment disputes

Implementing effective credit control procedures is difficult enough as it is for most small and medium...

Credit control and debt collection policy template for businesses (free template included)

Late payment of invoices is one of the major issues businesses in the UK have to overcome. Despite the...

Summary of the UK Law on Late Payment of Commercial Debt

If you have an unpaid invoice for goods or services, you are, by law, entitled to claim interest on...

Why Microsoft Dynamics 365 Business Central users should use Chaser

Combining the functionality of Microsoft Dynamics 365 Business Central with Chaser’s proven ability to...

What are payment terms? What, why, and how | Chaser

Establishing clear payment terms is one of the easiest steps on the road to getting paid on time and getting...

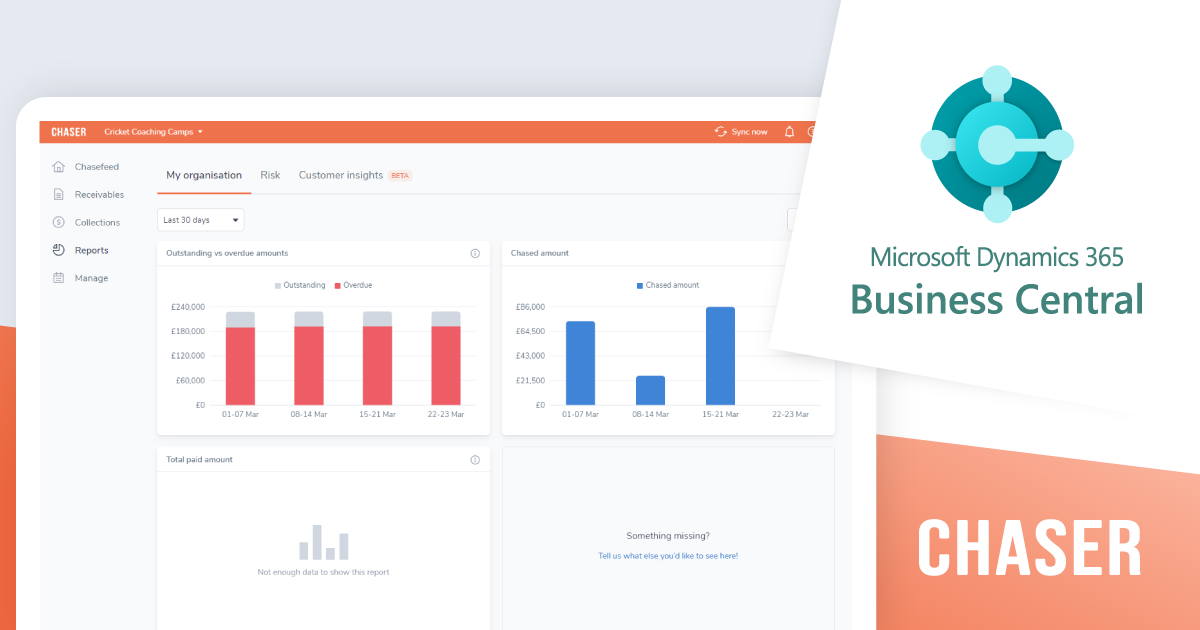

Faster invoice payments for Business Central users with Chaser

Microsoft Dynamics 365 Business Central users can now benefit from faster invoice payments with the leading...