Topic: Credit control & accounts receivables (15)

The rise of unpaid invoices in the creative agency sector

1 in 7 companies takes more than 14 days to pay on time. In 2018, almost half of payments clients made to...

Signs that you should be outsourcing your credit control

Credit control is much like a juggling act.

Are outsourced credit control services worth the money?

Getting on top of your credit control can often feel like running on a treadmill. You’re always exhausted but...

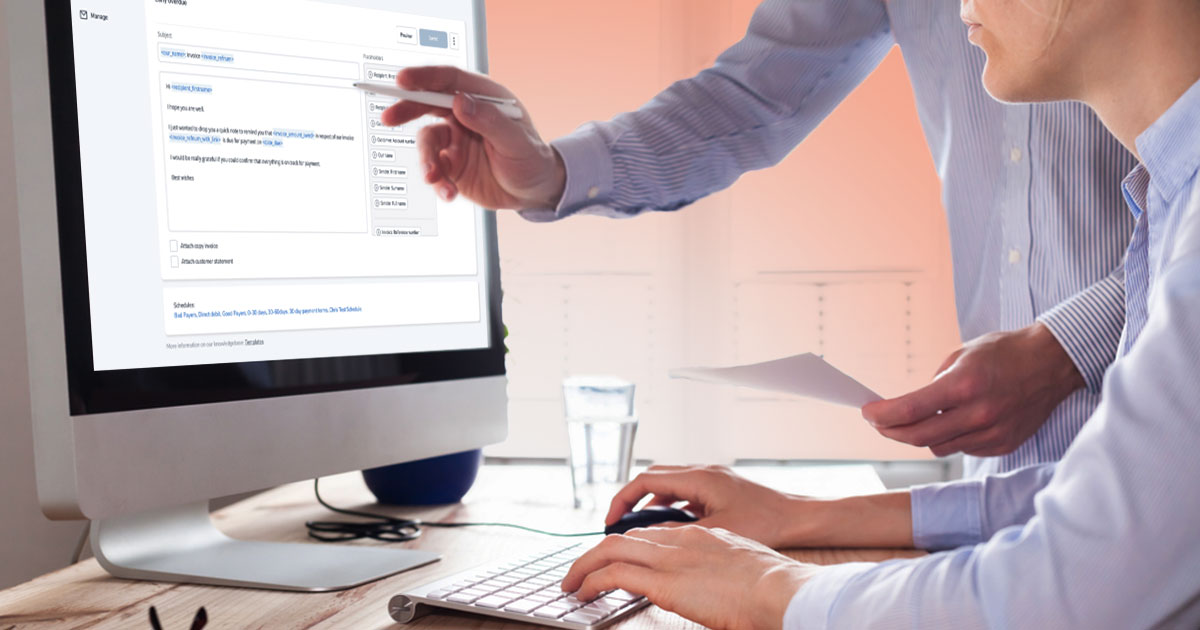

Benefits of all-in-one software

There’s no denying that there are a lot more software options out there today than at any time in the past....

The importance of customer credit checks

Landing a new client is usually great news — but only if you’re certain that the client will be paying their...

How to successfully manage your accounts receivable without a credit controller

How much does your business lose to bad debt or outstanding customer credit notes?

How accountants and bookkeepers support their clients with credit control

What is the hardest thing about running a small or medium business (SME)? If you are a business owner or...

Realistic budgeting and business credit terms

Realistic budgeting and the setting of effective credit terms are vital to keeping your business liquid.

Digital Accountancy Show 2021: Highlights from the event & Debtor Daze

This month the first large in-person event of the year for Accountants and Bookkeepers took place: the...

Chaser is exhibiting at the Accountex Summit North 2021 in Manchester

Chaser is proud to be exhibiting at the Accountex Summit North 2021. The two-day event on 20-21 September is...

Chaser is Xero's app partner of the month

Chaser is proud to be Xero's app partner of the month for August 2021 following major developments in the...

7 things all credit controllers should do

Many organizations provide their clients with credit facilities to increase the sales of their products or...