Chaser news & blog

Which Sage are you using? Here's how to find out

Sage offers a wide range of accounting software - such as Sage 50, Sage 200, Sage Business Cloud Accounting,...

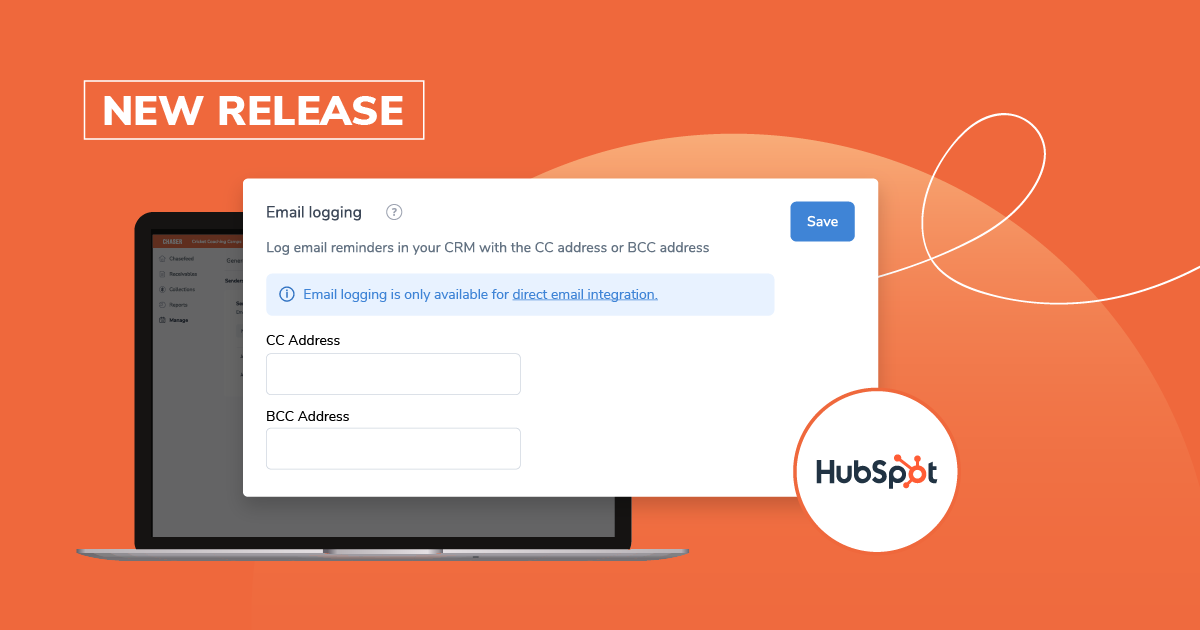

Track receivables conversations in HubSpot automatically using Chaser

Keeping a complete record of your customer communications is essential in accounts receivable—especially when...

Accounts receivable subsidiary ledger: What is it and how to use it?

Have you ever found yourself in this situation: your customer wants to extend their line of credit with you,...

Chaser is shortlisted for three Credit Strategy Awards 2025

Proud to share that Chaser has been shortlisted for three awards at the 2025 Credit Strategy Awards: Best...

How to make the most of Sage Future 2025

From June 3–5, 2025, finance leaders, innovators, and Sage users from across the globe will come together in...

.png)

Accountex London 2025: Highlights from the event

Last week Accountex London 2025 brought together over 11,500 finance professionals, accountants, and...

.png)

Chaser at DynamicsCon Chicago: Key highlights and AI in receivables

DynamicsCon Live Chicago 2025 brought together the global Microsoft Dynamics community for three impactful...

-1.png)

What to expect at Accountex London 2025 with Chaser

Are you planning to attend Accountex London 2025? Chaser will be exhibiting at this year’s premier accounting...

Chaser shortlisted for Best Use of AI in Fintech | Fintech Awards 2025

Delighted to share that Chaser has been shortlisted for the ‘Best Use of AI in Fintech’ award at the Fintech...

How to write a dunning letter | 3 example dunning letter templates

Late payments are a persistent challenge for businesses of all sizes. While polite reminders can work in some...

.png)

Free accounts receivable templates (Excel & Google Sheets)

Managing accounts receivable can be a time-consuming task, but it doesn't have to be. To simplify your...

What are uncollectible accounts & how to account for bad debt

Uncollectible accounts, also known as bad debt, represent the portion of accounts receivable that a business...