Chaser news & blog

What is debt collection and how does it work?

Most UK businesses lose £15,000 GBP+ annually to unpaid invoices, and the majority don't have a systematic...

Why accountants need to become finance strategists

The rapidly evolving accounting technology landscape is creating a dual need for accountants to be able to...

Lessons from advising high-growth CEOs at Deloitte and common mistakes

What I learnt from the crisis: Resilience, relationships, reinvention

Fresh out of university, I joined Northern Rock — the pride of the Northeast of England. It was more than a...

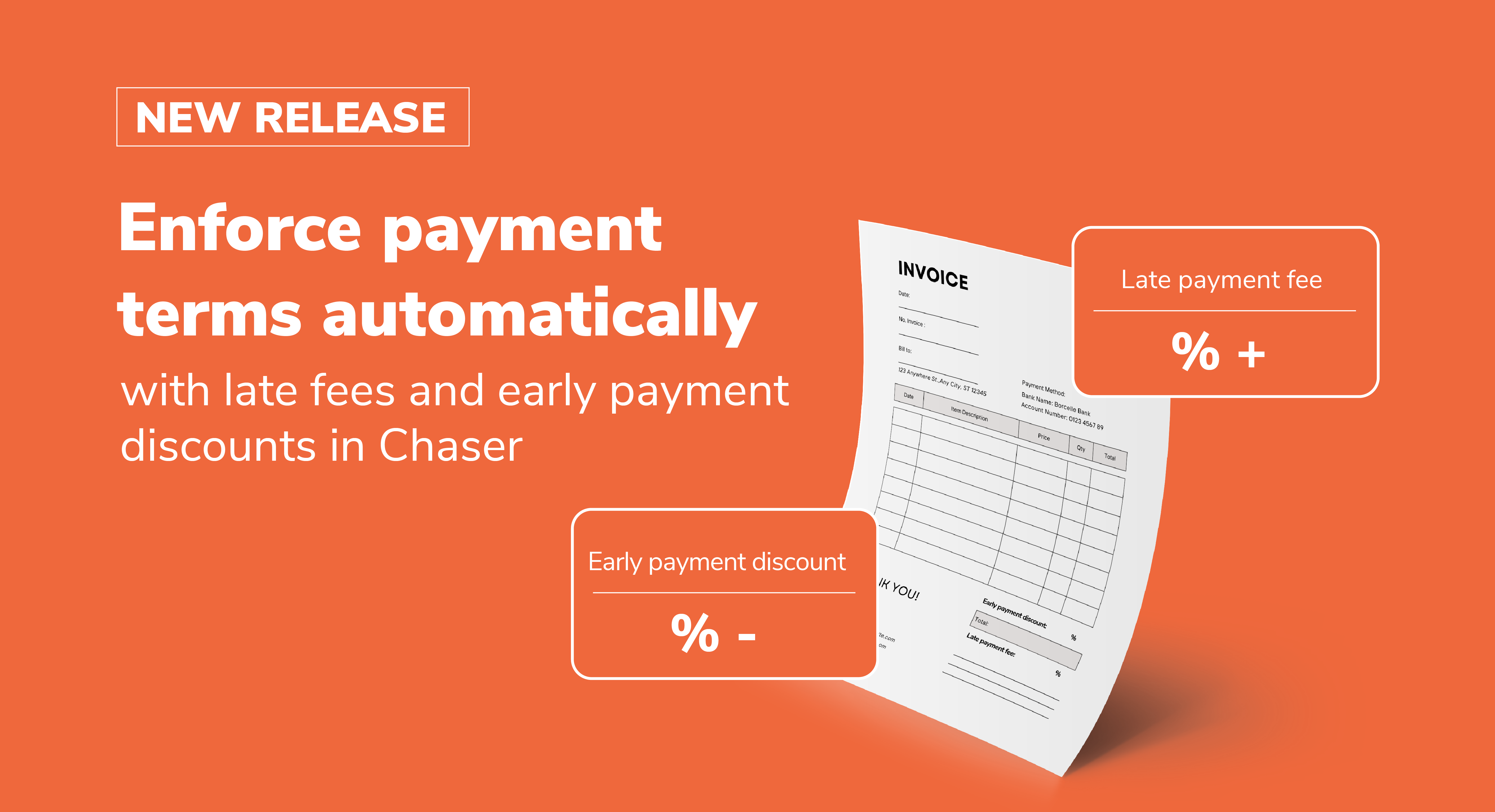

Enforce payment terms automatically: late fees and early discounts

Late payments are a major challenge for businesses worldwide, increasing financial uncertainty and...

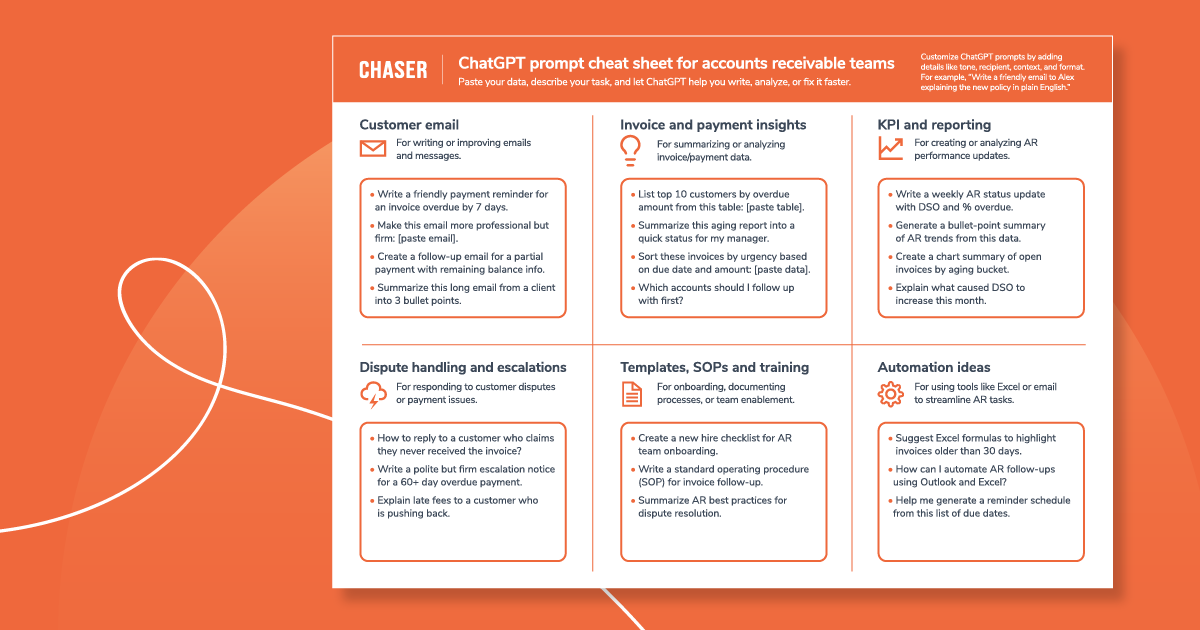

ChatGPT prompt cheat sheet for accounts receivable teams

Late payments are not just a cash flow problem — they derail forecasting, create bottlenecks, and increase...

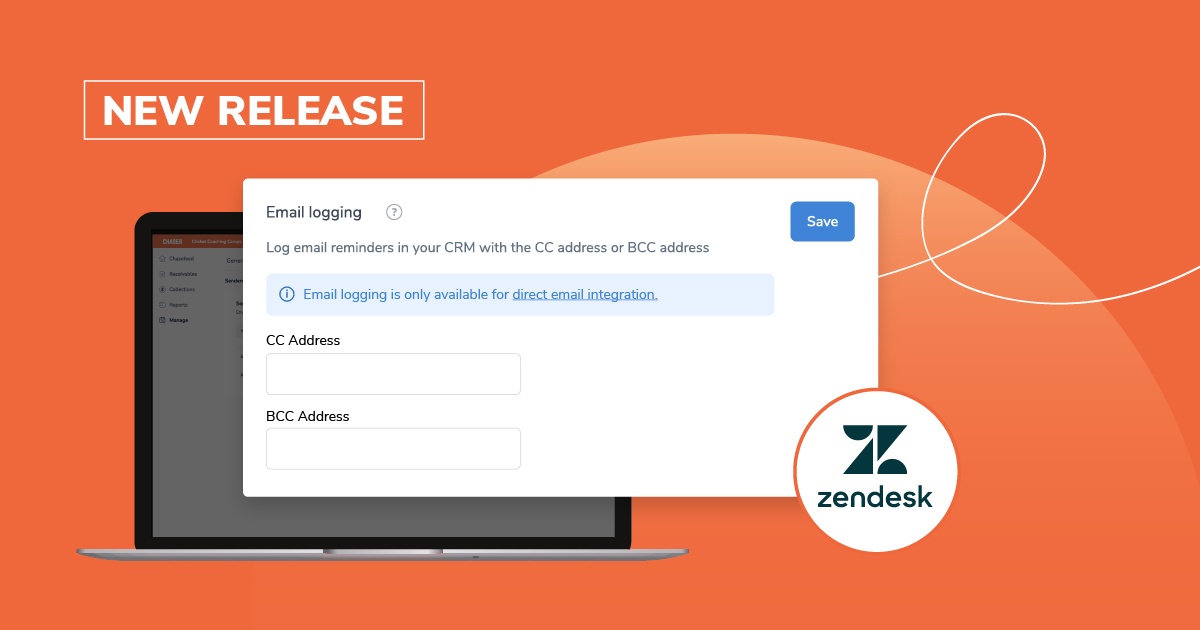

Streamline receivables: Auto-log Chaser emails as Zendesk tickets

Managing accounts receivable isn’t just about chasing payments — it’s about giving every team the visibility...

Chaser Care: Your dedicated receivable team powered by people and tech

Effectively managing accounts receivable goes far beyond simply sending invoice reminders. It involves...

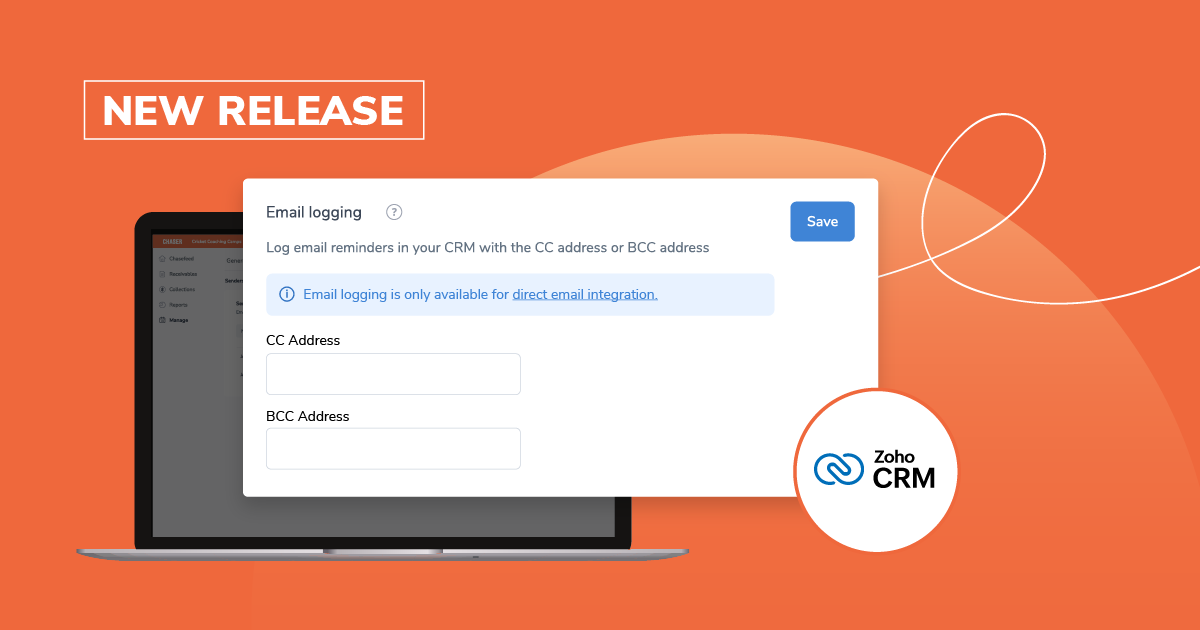

Keep your receivables visible: Auto-log Chaser emails in Zoho CRM

Managing accounts receivable is more than just sending reminders — it requires seamless collaboration across...

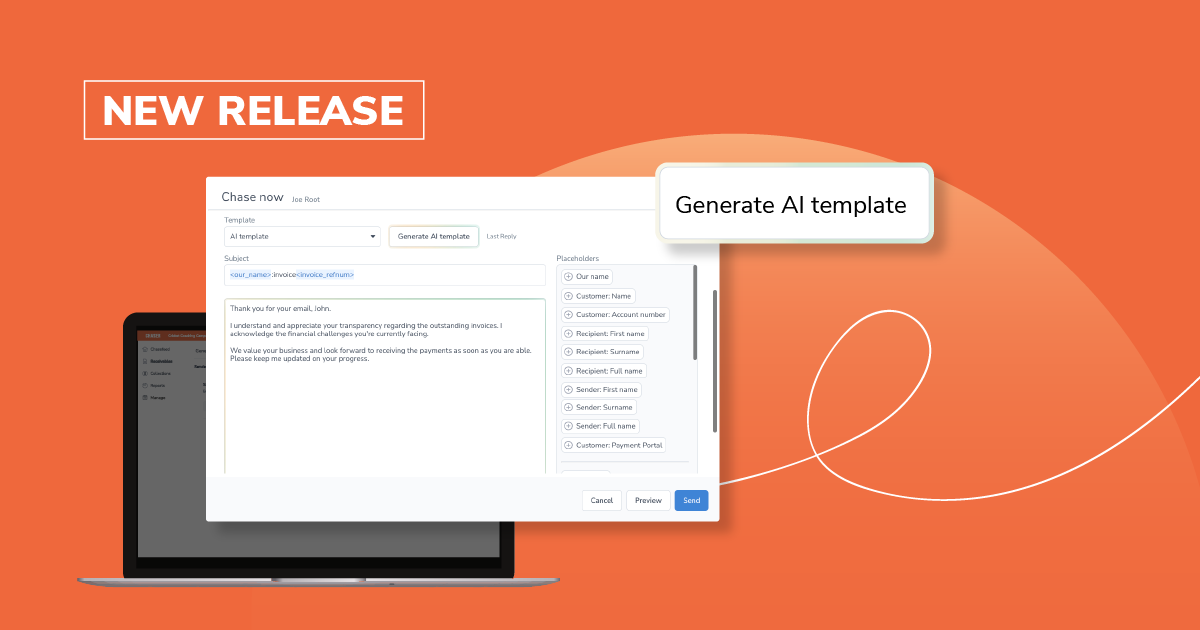

AI writes debtor email replies for you in Chaser: AI email generator

Artificial intelligence is no longer experimental. A recent McKinsey survey shows 78 percent of organizations...

Keep your receivables visible: auto-log Chaser emails in Pipedrive

Managing accounts receivable (AR) isn't just about sending reminders — it's about ensuring alignment across...

Automate receivables and manage credit risk with Chaser + Sage Intacct

Late payments continue to be one of the biggest barriers to business growth. With credit risk rising and...