Chaser news & blog

Charging late payment fees: Guide to legality and client communication

Late payments are a common problem for businesses. You've finished your work, but now you're waiting for...

.webp)

Accounts receivable aging report: Complete guide (+ free template)

You've done the work and sent the invoice, but your bank account doesn't reflect it. The key to controlling...

.png)

How to make the most of Xerocon Brisbane 2025

From3-4 September 2025, thousands of accountants, bookkeepers, and finance professionals will head to the...

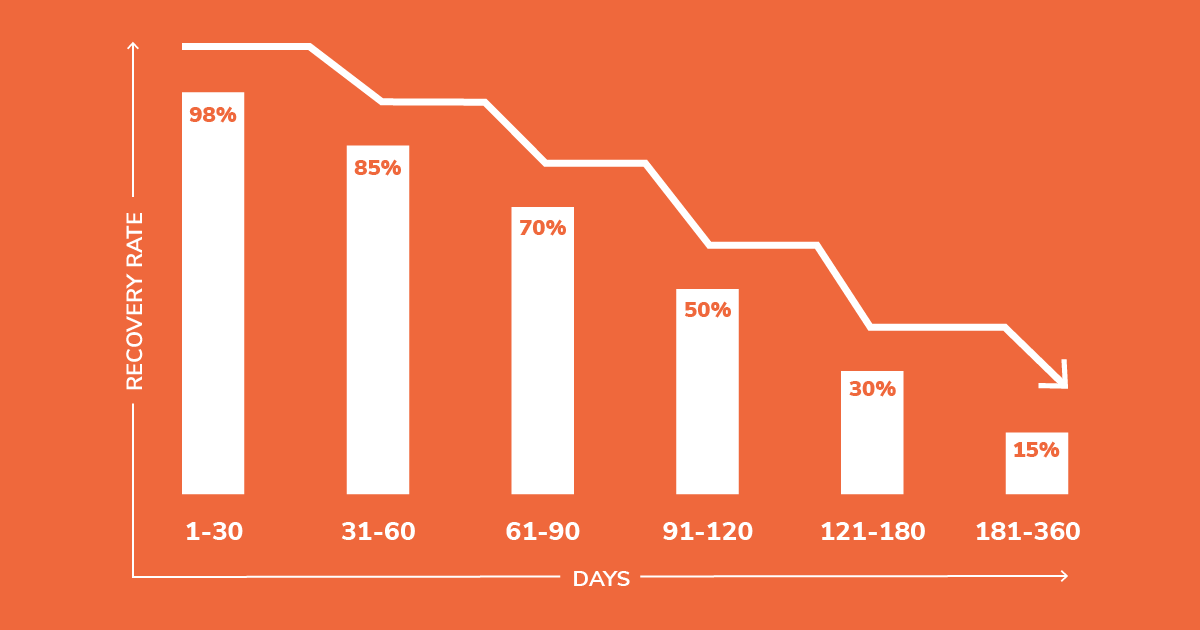

When to send unpaid invoices to collections (and why timing matters)

Every finance team has faced the same challenge: an invoice that lingers unpaid long after its due date. At...

Late payments still hold SMEs back: Truth behind the UK PM’s warning

A short post on X (formerly Twitter) has recently shone a spotlight on a challenge small businesses across...

.png)

How to accurately forecast accounts payable (walkthrough template)

Are you struggling to predict your upcoming expenses, leaving your business vulnerable to cash flow...

4 “thank you for your payment” emails to copy and paste

Looking for the right words to thank your customers for their payment? You're in the right place. Manually...

3 strategies to improve your cash conversion cycle

For many businesses, a high cash conversion cycle (CCC) is a silent killer. It means your own money is tied...

Balance sheet forecasting: How to forecast your key line items

Are you making critical business decisions, like whether to hire a new employee or buy new equipment, based...

What is debt collection and how does it work?

Most UK businesses lose £15,000 GBP+ annually to unpaid invoices, and the majority don't have a systematic...

Why accountants need to become finance strategists

The rapidly evolving accounting technology landscape is creating a dual need for accountants to be able to...