Accurate revenue forecasting is essential for effective financial planning and business growth. In fact, organizations with accurate forecasts are 10% more likely to grow their revenue year-over-year, and are twice as likely to be industry leaders (Argano).

With visibility over your organization’s future income, you can enjoy better liquidity management, and ensure you have enough resources to meet your operational needs. Access to an accurate revenue forecast can also provide your organization with greater confidence in making new investments, and help fuel your organization’s growth.

However, collating the right data points across multiple systems to build an accurate revenue forecast can be time consuming, and can often be inaccurate. Moreover, factoring in crucial elements like customer payment speeds, bad debt write offs, and credit notes and refunds can be painstaking to calculate, and can make accurately predicting your revenue near-impossible.

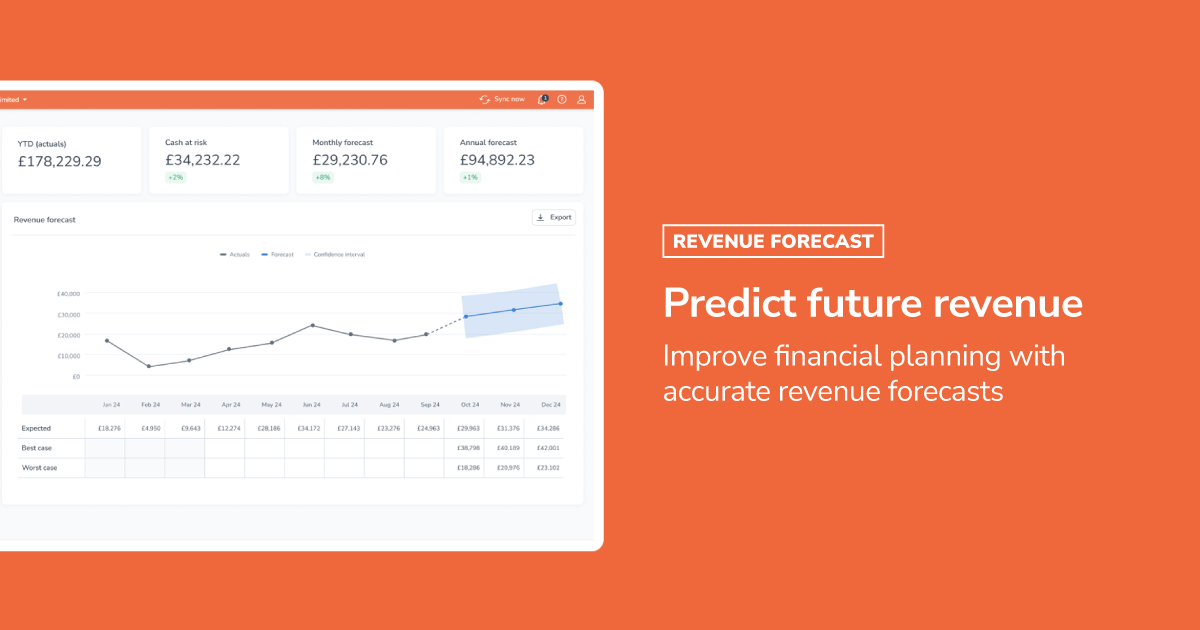

That’s why Chaser has created the Revenue forecast, which provides you with an automated, accurate revenue forecast that predicts your organization’s future revenue. Improve your financial planning and collect and forecast your revenue in one system with the Revenue forecast in Chaser.

Benefits of the Revenue forecast in Chaser

Improve financial accuracy: Benefit from accurate revenue predictions based on advanced machine learning models. Ensure your financial forecasts are reliable and precise.

Save time: Automate your revenue forecasting to reduce the manual work involved in financial planning. Spend less time on lengthy calculations and more time on strategic decision-making.

Make better-informed decisions: Gain accurate insights into your future revenue trends, enabling you to make informed decisions regarding credit management, inventory purchases, and investment opportunities.

Reduce financial risks: Proactively address potential financial risks by forecasting revenue trends and issues before they become problems. Reduce the likelihood of financial distress.

Flexible to your needs: Edit your year end and start to match your organization's requirements, and easily export and share revenue forecast data with key stakeholders.

To see full details on the benefits of the new Revenue forecast feature in Chaser, download the fact sheet.

How does the Revenue forecast work

The Revenue forecast uses cutting-edge machine learning to provide you with the most accurate forecast possible. The calculation considers over 65 data points including your customers’ geo-specific economic conditions (regulations, market trends), seasonality, past financial trends, payment history, and much more.

Key data points such as your organization's Year-to-date actuals, total Cash at risk, Monthly income forecast, and Annual revenue forecast will be available in your Chaser account, automatically. So you no longer need to spend time manually calculating these KPIs for your business, as Chaser will calculate and update them every month for you. Learn more in the help center article.

Within the Revenue forecast, you’ll also get a monthly estimate of how much revenue will likely go uncollected due to unpaid debts for the remainder of your fiscal year. Use Chaser’s wider receivables management tools to adapt your credit management strategy and take preventative action to reduce your organization’s financial risk and protect your revenue based on these insights.

How to start using the Revenue forecast in Chaser

- Create a Chaser account:

Start using Chaser for free (no card details required) for 14 days at chaserhq.com/signup. - Choose an Enterprise plan:

Click on the person icon in the top right hand corner of your Chaser account, select Organization settings, then Subscriptions, and select the Enterprise plan. - View your Revenue forecast:

Click on “See More” on the Forecast chart in Chasefeed, then view your Revenue forecast report in Chaser.

Leveraging accurate revenue forecasts through the new Revenue forecast feature in Chaser can significantly enhance your financial planning and business operations. By automating the complex process of revenue forecasting, Chaser allows you to streamline your financial strategy, reduce manual workload, and make more informed decisions.

Start your free trial today, or learn more about the Revenue forecast in this fact sheet.

.jpeg)