Cash is king. Not anymore! Cash has been supplanted. Now, convenience is king, and the better you are at providing it, the more likely you are to attract attention in a highly competitive market.

The vast majority of consumers now expect fast and frictionless payment journeys. 88% claim they would abandon a purchase if they met with any friction at the point of sale. And, for 76% of consumers, overcoming this friction requires increased choices in how companies accept payments.

For the companies in question, convenient payment processing directly into a merchant account also means quicker payments and less risk of things like the unpaid invoices that plague more than half of small businesses right now. This is true whether you’re operating a physical or online store, and delivering this benefit ultimately comes down to one crucial thing – your ability to offer an online payment process that everyone can get behind.

After all, four in five UK consumers are now digital buyers, and that figure is expected to reach 86% by 2027. Contactless payments also now make up a third of payments in the UK. Your payment solutions need to reflect that switch, no matter where you are in your business journey. Your online payment processing also needs to provide choice, ease, and all-important frictionless finishes.

If you care as much about getting paid as you should, then you need to know about the best online payment options for small businesses right now. So, let’s get started.

four in five UK consumers are now digital buyers, and that figure is expected to reach 86% by 2027.

What do you need to know about online payment processing?

As a consumer and a business owner, you understand the basic concept of online payment processing solutions. But, it might help to delve a little further into what exactly the term ‘online payments’ covers.

For instance, while online payments refer broadly to a credit card or digital transaction that takes place using an internet connection, online payment can cover both virtual and in-person services or products. Online payments also include in-person payment options like contactless payments.

Online payments can also refer to both one-off payments for a service or product, and subscription or recurring billing for an ongoing service. Taking payments online makes it far easier for a payment processor to process transactions directly into your merchant account according to things like a subscriber model without the risk of missed payment dates.

Why should you process payments online?

Why should you accept online transactions if you’ve been doing just fine until now?

In a way, we’ve already covered the reasoning for this in our introduction – consumers now expect a payment process that offers both choice and ease. Online payment processors provide each of those in spades.

But, how does all of this benefit you as a business?

Well, we’ve covered that a little, too. When you offer easy and accessible payment tools, you increase your chances of getting paid using a direct link to consumer bank accounts. When you process payments online, you can also enjoy a range of lucrative benefits, including –

- Faster payments

- Improved reputation

- Low transaction fees

- A wide variety of payment processing choices

- Simplified management of financial data

- Recurring payment capabilities

- Better customer experiences

Online payment methods for small businesses

If you’re a small business, online payment methods are accessible to you too. Even if your business is service-based. Consumers increasingly expect small businesses to offer all payment forms in keeping with larger companies. More reliable, fast-fire online payment tools even stand to save the two million small businesses falling foul of late payments right now.

Of course, online transactions aren’t an entirely new concept in the small business sphere. These days it’s not uncommon to send and receive invoices by email. Actually, it’s encouraged. When you send an invoice by email, it’s quite easy to incorporate a link to an online payment gateway at the same time. The same goes for sending out your payment reminders.

However, many small businesses haven’t dedicated much time to thinking about which is the best online payment option for their purposes. Yet, to get online digital or online credit card processing right, small businesses could benefit from thinking about how to reach their clients with the most current and convenient options so that it’s easy for them to pay.

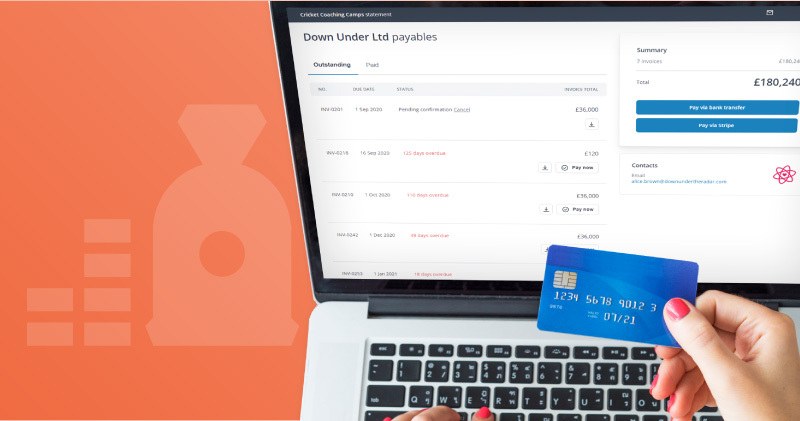

In a constantly changing online world, personally staying up-to-date isn’t always financially or practically possible. That could see small businesses falling behind when it comes to accepting credit card or other online payment solutions. However, if you use accounting software, you can make your own life easier by ensuring an integrated payment processing solution that works with the systems you already have. Chaser’s payment portal really helps you out here.

Types of online payment methods

It’s quite natural to think of online transactions as taking place from behind a computer. However, now that contactless payments have become a thing, slippers and a cup of coffee aren’t involved in these deals as much anymore. Online payments can take place even when your customer (or client) is standing right in front of you.

Which online payment tools should you offer? There isn’t a one-size-fits-all solution. Instead, the best online payment solution will depend on everything from your business model, to your location and the type of consumers you’re dealing with.

But, you can’t choose the best online payment tools if you don’t know your options. So, what are your choices when it comes to online payment processing? There are a few, and each of these payment processing tools offers very different benefits and opportunities.

Below are five popular online payment processor options:

1. Payment gateways

A payment gateway is software that enables a company to accept credit card and debit card transactions as required. Most people expect to be able to pay by online credit card transaction whether they’re shopping in-store or online with e-commerce businesses. A physical POS system counts as a kind of payment gateway, as do online checkouts on e-commerce sites. Payment gateways are crucial for processing credit card payments.

Some of the most widely accepted credit cards are:

- MasterCard

- Visa

- American Express

- Discover

A payment gateway will encrypt confidential client data that is transferred during the payment process in communication with the customer’s bank account issuer. The encryption, communication, and approval all happen within a matter of seconds, and that information is then fed to a company’s payment processor.

Payment gateways keep transactions secure. If a customer feels just a little unsure about releasing their payment or bank account information to you, they might abandon their cart and go somewhere else. That’s not what you want. A payment gateway is designed to instil confidence in your customers while protecting you from unnecessary loss of sales.

And improved security isn’t the only benefit of a payment gateway either in-person or online. 48% of consumers still report credit card payments as their preferred payment method of choice. With a payment gateway, businesses can enhance customer experiences, appeal to audiences of all ages, and automate the fast processing of any payments.

2. eWallets

Remember when we said that cash was no longer king? Well, that fact is cemented by the reality that 20% of people now prefer eWallet payments like Apple Pay compared with just 17% who prefer cash. Yet, with eWallets still arguably the newest contenders on the payment block, small business owners may make the mistake of overlooking this rising favourite way of processing payments.

An eWallet (or digital wallet), ultimately operates in the same way as a physical wallet. Only, this payment method allows a customer to use their smartphone to make a secure payment, either in-store or through a website. Transacting is fast, secure and convenient, and could be seen as a natural evolution of digital payments in general. Much like credit card transactions, eWallet payments are also easy for consumers to manage, and rely on existing, password-protected eWallet accounts that save consumers from having to type lengthy bank account details by hand.

A few examples of the most popular eWallet payment processing tools right now include:

- PayPal

- Apple Pay

- Samsung Pay

- Amazon Pay

- Google Pay

As long as a customer has their phone with them, they can provide immediate information to your payment processor. eWallets are one step up from credit card processing in terms of both ease and security and choosing this payment method can especially appeal to audiences between the ages of 16-24, over half of whom are registered for mobile payments.

The fact that there are various choices for eWallet payments to suit every software preference is especially beneficial. Without incurring additional payment processing fees, businesses can offer the choice favoured by modern consumers in even this one online payment option.

3. Electronic funds transfer

Electronic funds transfer (EFT) is a payment tool that has been widely used for quite some time. You’re probably already familiar with how it works. This option allows your customer to deposit funds from their bank account into your bank account using internet banking. To make use of EFTs, businesses simply require a merchant account and payment processing services.

There are a few different examples of EFT payment systems, including:

- Electronic cheques

- Phone payments

- Direct deposits

- Debit card payments

- Internet payments

EFT payments are a cost-effective, quick payment option with little effort required for either a consumer or payment processor. EFT payment processing also brings international payments within easier reach thanks to the potential for cost-effective, straightforward overseas transfers without risks like incompatible software or bank processing blockages.

EFT payments are also great for in-person and online businesses that generate recurring payments or manage subscriptions, as they can be automated to recur at specific intervals. This allows for reliable, ongoing payment processing that you and your clients won’t need to think twice about.

4. Cryptocurrency

Cryptocurrency is a form of decentralised digital payment that’s been growing in mainstream popularity for some time. Cryptocurrency’s popularity largely stems from the fact that these digital funds can be sent instantly, and use encrypted coding to ensure security. A lack of a central intermediary can also significantly lower transaction fees.

If you’re really into keeping up with the times, you might want to consider accepting cryptocurrency payment processing. However, not everyone uses crypto, so that will depend on your customer base and the type of business you run.

Accepting cryptocurrencies for things like invoice payments certainly holds some appeal, as crypto transactions can’t be faked or reversed. Cryptocurrencies are also becoming more popular across even mainstream businesses, and are currently accepted by companies such as –

- Amazon

- Microsoft

- PayPal

- Etc.

However, small businesses may face certain barriers when accepting cryptocurrencies, including the need for a digital wallet on a digital currency exchange. Taxation on crypto payments is also relatively complex right now. Not to mention that, as it stands, 50% of consumers still think that highly variable cryptocurrencies are a risky financial option. Those that do use cryptocurrencies tend to be in a younger age range of around 18-35.

Before accepting cryptocurrency, businesses therefore need to think about things like target audience and technical capabilities. That said, crypto is becoming an increasingly accessible option for secure transactions as more brands opt to use it. With the help of well-versed payment processing companies, this could therefore be a viable option for future transactions if you believe there’s an audience demand.

5. Quick response codes

Every business now recognises the use of QR codes for things like marketing, but did you know that QR codes offer another way of processing a payment from a smartphone? In fact, QR codes that link to online payment systems are increasingly popular thanks to their ease, and ability to digitise even in-person transaction information.

If you run a coffee stand that serves people on their morning commute, offering a QR code makes perfect sense. But, this payment tool isn’t limited to on-the-go beverages. As you probably already know, you can pay for all sorts of things, even accounts, with QR codes. Including a QR code on a monthly invoice can even make this a great option for payments recurring on subscription services or instalment payments.

With a little creativity, you can apply QR codes to almost anything. And, most banks have included code scanners on their mobile banking apps, making this a viable quick payment option for most businesses.

All that you need to make good use of QR codes for payment is a merchant account, a payment processor, and the ability to generate QR codes that bring it all together.

What are the best payment tools?

What are the most popular online payment methods? Statistics show that eWallets are the clear winner in the global online payment popularity contest. The runners-up are credit and debit cards followed by bank transfers.

So how do you choose what to offer your clients? It’s not about finding that one perfect solution, especially considering that UK consumers report using a variety of different payment methods to make their purchases. If anything, the best option for online payment platforms is actually to use a few.

At the end of the day, tailoring the right combination of payment methods means that your customers can pay you instantly and easily. It’s an effective way of guiding your customers to the point where they can pay you on time.

Convenience means letting your customers choose the option that suits them the most. Making payments as easy as possible is a good way to encourage your clients to make their payments promptly. As we all know, getting paid on time is key.

In short, the answer is variety. Offering the right variety of choices is the best option for receiving online payments.

So how do you choose what to offer your clients? It’s not about finding the perfect payment processing solutions. It’s about offering variety to meet the needs of as many of your clients or customers as possible.

Taking your business to the bank

There's much research and admin involved in setting up the right online payment systems. If you’re feeling slightly overwhelmed, just know that there is an easier way.

Are you feeling unsure about how to set up online payments for your business? Chaser offers a payment processor portal that’s just as convenient for you as it is for your customer base. You don’t have to stress about all the types of online payments, or whether or not your platform will be secure. Chaser has done that leg work for you.

You can offer your customers the information they need to pay in a professional, one-stop arrangement that also provides access to multiple payment options. And it’s instant.

Start your free trial here.