Accounts Receivable (AR) and credit control are essential function in any business. This involves managing and recording incoming payments from customers for goods or services provided by the company. Keeping track of accounts receivable can be time-consuming, as it requires attention to detail and diligent record-keeping.

Accounts receivables and credit control processes frequently demand a significant amount of manual effort due to the complexities involved in managing customer accounts and mitigating credit risk. This manual work encompasses tasks such as manually inputting sales transactions, generating invoices, reconciling payments, and monitoring customer payment behaviors.

Additionally, credit control necessitates hands-on attention to evaluate the creditworthiness of customers, establish credit limits, and chase overdue payments through personalized communications and collection efforts.

Despite advancements in technology and automation, many businesses still rely heavily on manual processes for accounts receivables and credit control, especially smaller businesses with limited resources. As a result, the workload associated with these tasks can be intensive and time-consuming, requiring dedicated personnel to oversee and manage these critical financial functions effectively.

This is where Chat GPT (Generative Pre-trained Transformer) comes into play. Chat GPT is an AI-based chatbot that helps streamline communication and certain tasks, particularly copywriting responses to customer queries about late payments or invoices.

In this blog, we will discuss how Chat GPT can help accounts receivable managers and credit controllers and the benefits it brings to the overall receivables process.

What is Chat GPT?

Before diving into the specifics of how Chat GPT can help accounts receivable, it's essential to understand what it is and how it works.

Chat GPT is a type of AI technology that uses natural language processing (NLP) and machine learning algorithms. It is designed to mimic human conversations by analyzing input text and generating appropriate responses.

This chatbot has been pre-trained on a massive amount of data, making it capable of understanding and responding to various types of conversations. As with many NLP-based technologies, the more it interacts with humans, the smarter it becomes.

As interesting as this is, you may be wondering how this technology can assist with accounts receivable. Let's take a closer look.

How Chat GPT can help Accounts Receivable

With Chat GPT, businesses can create and write templates for emails, SMS, phone scripts related to chasing late payments. Below are some specific ways in which Chat GPT can help manage accounts receivable:

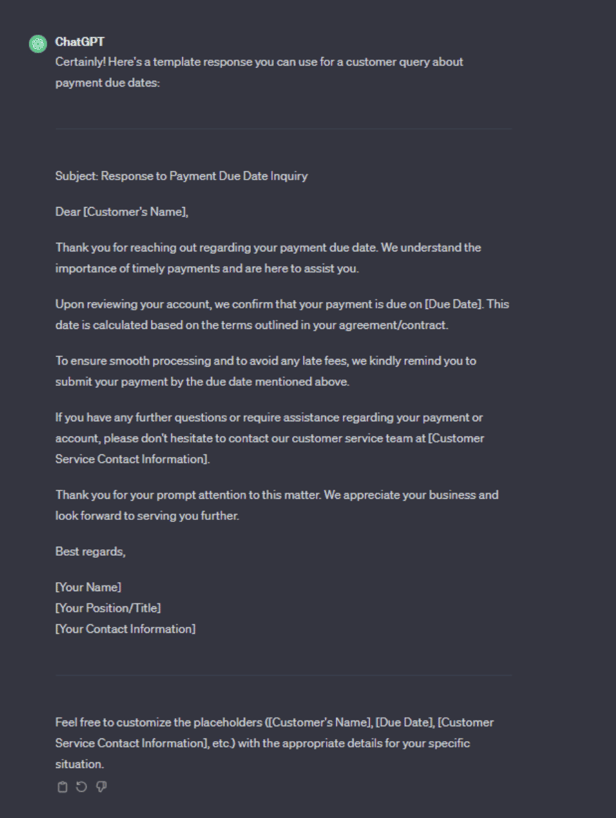

Customer queries

Chat GPT can generate responses to customer queries related to accounts receivable. This includes invoice inquiries or payment due dates. See the example below. Using Chat GPT to help draft responses can represent a huge time saving for credit controllers and accounts receivables managers, who may struggle to find the write tone or the right words for the response.

This reduces the workload for AR employees and ensures a timely response to customers' queries.

Using Chat GPT to help draft responses can represent a huge time saving for credit controllers and accounts receivables managers, who may struggle to find the write tone or the right words for the response.

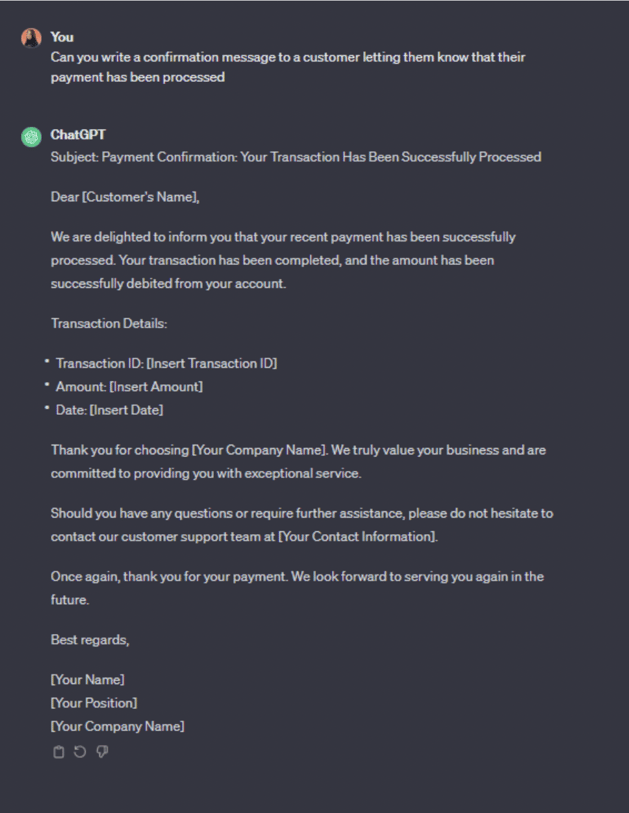

Template generation

Chat GPT can also write confirmation messages to both the customer and AR employees, ensuring transparency and accuracy in payment processing. This feature also helps reduce the chances of payment errors or delays.

Benefits of using Chat GPT for accounts receivables managers and credit controllers

Using ChatGPT to generate well-written templates can provide numerous benefits to accounts receivables managers and credit controllers in streamlining their communication processes and enhancing their efficiency. Here's how:

- Consistency: With ChatGPT-generated templates, accounts receivables managers and credit controllers can ensure consistency in their communications. Each message will adhere to the same tone, language, and formatting, maintaining a professional image for the company.

- Time-saving: Instead of manually drafting each communication from scratch, which can be time-consuming, using templates generated by ChatGPT allows managers to quickly select or customize pre-written messages. This frees up time for them to focus on other important tasks, such as analyzing financial data or resolving complex issues.

- Accuracy: ChatGPT can help ensure that communications are accurate and error-free. The AI model can assist in crafting precise and clear messages, reducing the risk of misunderstandings or miscommunications with clients or debtors.

- Personalization: While templates provide a standardized approach to communication, they can still be personalized to some extent. ChatGPT can generate templates that allow for customization, such as inserting specific client names, invoice numbers, or payment amounts, making the communication more relevant and engaging for the recipient.

- Compliance: Accounts receivables managers and credit controllers often need to adhere to legal and regulatory requirements when communicating with clients or debtors. ChatGPT-generated templates can help ensure that communications are compliant with relevant laws and guidelines, reducing the risk of legal issues or disputes. ChatGPT can also help by stating when legal advice should be sought.

- Efficiency in scaling: As businesses grow, the volume of communications related to accounts receivables and credit control also increases. ChatGPT-generated templates can easily scale to accommodate this growth, allowing managers to efficiently handle a larger number of communications without compromising on quality.

- Adaptability: The needs of accounts receivables and credit control departments may evolve over time due to changes in business processes or industry standards. ChatGPT can quickly generate new templates or modify existing ones to adapt to these changes, ensuring that communications remain effective and relevant.

Overall, leveraging ChatGPT to generate well-written templates offers accounts receivables managers and credit controllers a valuable tool for enhancing communication efficiency, maintaining consistency, and ensuring compliance, ultimately contributing to improved financial management and client relationships.

What are the major roadblocks for Chat GPT in accounts receivable management and credit control?

In the realm of accounts receivable management and credit control, ChatGPT faces several significant roadblocks that can hinder its effectiveness:

- Complexity of financial data: Financial data, particularly in accounts receivable, can be highly complex and varied. It may include invoices, payment histories, customer details, and more. Processing and understanding this data accurately can be challenging for an AI system like ChatGPT.

- Variability in customer communication: Customer interactions regarding payments can vary greatly in tone, urgency, and specific requests. ChatGPT needs to adapt to these variations effectively to provide appropriate responses.

- Regulatory compliance: Compliance with financial regulations and privacy laws is crucial in accounts receivable management. ChatGPT must ensure that its communications and actions comply with these regulations.

- Lack of contextual understanding: ChatGPT may struggle to understand the broader context of a customer's financial situation, including factors such as market conditions, industry trends, or individual customer circumstances.

- Human emotion and interaction: Credit control often involves sensitive communication regarding late payments or outstanding debts. Understanding and appropriately responding to human emotions and interactions can be challenging for AI.

The use of a credit control automation platform like Chaser can address many of these roadblocks and enhance the efficiency and effectiveness of credit control and receivables management:

- Automated invoice chasing: Chaser's workflow capabilities allow for the automation of invoice chasing, reducing the need for manual intervention and ensuring timely follow-up on outstanding payments.

- Integration with accounting systems: Seamless integration with accounting systems streamlines the reconciliation process, ensuring that financial data is accurate and up-to-date.

- Customer portals: Providing customers with self-service portals enhances transparency and allows them to track their invoices and payments, reducing the need for direct communication and inquiries.

- AI-powered insights: Leveraging AI for payer ratings, recommended chasing times, late payment predictor, and other insights helps prioritize tasks and optimize credit control strategies based on data-driven recommendations.

- Workflow management: Chaser's workflow features enable the setup of schedules and escalation processes, ensuring that credit control tasks are managed efficiently and effectively.

Overall, a credit control automation platform like Chaser complements ChatGPT by providing the necessary infrastructure and capabilities to overcome the roadblocks in accounts receivable management and credit control, ultimately leading to smoother operations and improved financial performance.

How to use Chat GPT alongside in accounts receivable software

While the benefits of using Chat GPT for accounts receivable and credit control are numerous, there are some potential roadblocks to consider. To overcome potential roadblocks and successfully implement Chat GPT for accounts receivable, businesses can follow these steps:

Define goals

Clearly define the goals you aim to achieve by using Chat GPT in AR. This will help determine which tasks and processes to automate, leading to a more targeted implementation. By setting specific and measurable goals, businesses can also track the success of their implementation.

Plan for integration

As mentioned earlier, integrating Chat GPT with existing AR systems may require technical expertise and resources. Businesses must plan for this process in advance to ensure a smooth implementation. By involving IT teams and seeking professional help if needed, businesses can ensure a successful integration.

Communicate with employees and customers

Transparency is vital when implementing new technology that involves handling sensitive data. Businesses must communicate the benefits of Chat GPT to their employees and address any concerns or training needs they may have.

Moreover, businesses must also communicate with customers about the use of Chat GPT and assure them of their data's protection.

Provide proper training

Invest in thorough training for AR employees to help them understand how to use Chat GPT effectively. This can also include providing resources such as FAQs or guidelines for interacting with the chatbot. By providing proper training, businesses can ensure that employees are maximizing the benefits of Chat GPT.

Chat GPT best practices for AR Teams

To ensure the successful use of Chat GPT in accounts receivable, here are some best practices that AR teams can follow:

● Choose the right platform that aligns with your goals and integrates seamlessly with existing systems.

● Clearly define your goals and track the success of your implementation.

● Communicate with employees and customers about the use of Chat GPT, addressing any concerns or training needs.

● Monitor performance and gather feedback to make necessary adjustments and enhancements.

● Invest in proper training for AR employees to ensure they are using Chat GPT effectively.

By following these best practices, businesses can overcome roadblocks and successfully implement Chat GPT in accounts receivable, ultimately improving efficiency and providing valuable insights for the organization.

Stay human

As technology continues to advance, it's essential for businesses to stay updated and use tools like Chat GPT, as well as credit control platforms like Chaser, to streamline processes and stay competitive in the market.

Tools like ChatGPT are incredibly useful for generating templates, whether for emails, invoices, or any other form of communication. They can save time and provide a solid starting point for crafting professional and effective messages. However, it's crucial to remember that while templates can streamline our workflow, they should never sacrifice the human touch and personalization that are essential for successful communication, particularly when it comes to delicate matters like invoicing and ensuring payment.

When sending invoices, for example, it's tempting to simply use a standard template and fire it off to clients without much thought. However, taking the extra time to personalize your message can make a significant difference in how it's received. Personalization shows your clients that you value the relationship and that you're attentive to their individual needs and circumstances.

Here are a few tips for humanizing and personalizing your invoice communications:

- Address the recipient by name: Use your client's name in the greeting rather than a generic "Dear Sir/Madam." This small gesture can make the message feel more personal and engaging. Software like Chaser can help personalise this further.

- Acknowledge past interactions: If you've had previous communications or transactions with the client, briefly reference them. This demonstrates that you have a history together and reinforces the personal connection.

- Tailor the message to the recipient's situation: If there are specific details or circumstances related to the invoice, such as project milestones or agreed-upon terms, mention them in your message. This shows that you're paying attention to the specifics of the transaction and ensures clarity for both parties.

- Express gratitude: Always thank the client for their business and for their prompt attention to the invoice. Gratitude goes a long way in fostering goodwill and strengthening the client relationship. Chaser will send a thanks for payment message.

- Provide avenues for communication: Encourage the client to reach out if they have any questions or concerns regarding the invoice. This demonstrates your openness to communication and willingness to address any issues promptly.

- Sign off with a personal touch: Instead of a generic closing like "Sincerely," consider using a warmer closing such as "Warm regards" or "Best wishes," followed by your name. Adding a personal touch to the closing can leave a lasting impression.

By incorporating these personalized touches into your invoice communications, you not only increase the likelihood of prompt payment but also strengthen your client relationships and foster a positive reputation for your business. While templates can provide a framework for your messages, it's the human element that truly sets them apart and ensures their effectiveness.

With proper planning, implementation, and best practices, Chat GPT has the potential to revolutionize accounts receivable for businesses of all sizes. So don't let roadblocks hold you back from exploring this innovative technology - embrace it and see how it can transform your AR process.

For more information on how to successfully supercharge your accounts receivable, check out the Chaser blog or book a demo to see how Chaser can help you streamline your AR process.