Chaser news & blog

%20-%20Uplow%20alternatives.webp)

6 Upflow alternatives for mid-market AR automation

As a finance manager or CFO, inefficient AR software creates real problems: it locks up cash, scatters...

%20-%20Cash%20flow%20software%20(1).webp)

5 best cash flow management software to improve working capital

Unpredictable cash flow creates operational drag for finance teams. AR teams spend significant time on manual...

%20-%20Cash%20flow%20management%20software.webp)

7 best cash collection software to get paid faster in 2026

If you’re running a mid-market business today, managing cash flow has likely become a relentless balancing...

%20-%20Automate%20debt%20collection.webp)

6 best debt collection software in 2026: reduce DSO by 75%

As a CFO or finance manager, you know that unpaid invoices aren’t just numbers. They lock up cash, complicate...

%20-%20AR%20collection%20process.webp)

Modern accounts receivable collection process: A guide to faster payments

Most finance teams do not need another textbook explanation of the accounts receivable collection process....

%20-%20Reduce%20DSO.webp)

How to reduce DSO: Proven strategies to improve cash flow

A healthy P&L and a growing top line should feel like success. For many mid-market finance leaders, it feels...

%20-%20Cash%20collection%20formula.webp)

Cash collection formula: The complete guide to forecasting when customers will pay

In textbooks, the cash collections formula looks simple:

A year in review: Chaser’s impact on businesses in 2025

As 2025 comes to a close, it is a moment to reflect on a year shaped by steady progress, practical...

%20-%20DSO%20formula.png)

Days Sales Outstanding formula + 3-pillar reduction guide

If your cash flow feels unpredictable and slow, or if you've noticed excessive delays in collecting payments...

%20-%20How%20to%20forecast%20cash%20flow_%20Data%20gathering%2c%20troubleshooting-1.webp)

How to forecast cash flow: Data gathering, troubleshooting, + template

Inconsistent results from your cash flow forecasts are a common, but not inevitable, part of the forecasting...

%20-%20AR%20automation_%20What%20it%20is%20and%20to%20automate%20your%20accounts%20receivable.png)

Accounts receivable automation: What it is and how to automate it

Most AR teams spend their mornings the same way:

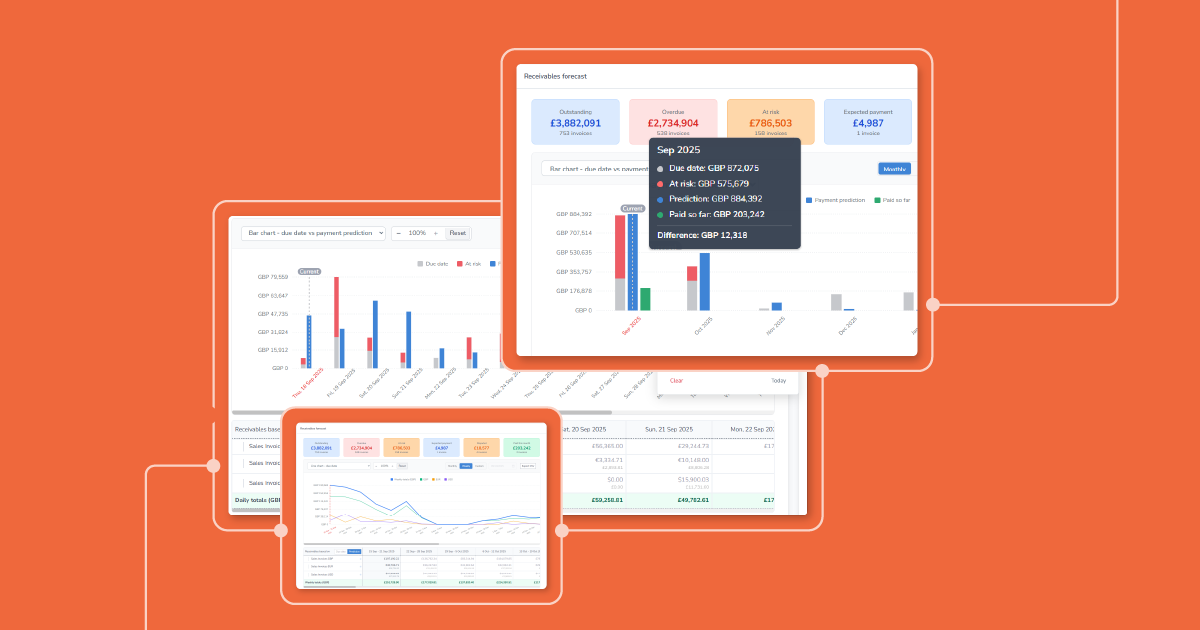

Get clarity on expected payments through receivables forecasting

Uncertainty over incoming payments makes financial planning harder than it needs to be. Even with accurate...