Accounts receivable insights

Tips tools and strategies for businesses to reduce late payments, improve the accounts receivables process, and get invoices paid sooner.

Take the late payment survey and earn a $15 USD voucher

Tips tools and strategies for businesses to reduce late payments, improve the accounts receivables process, and get invoices paid sooner.

See how sending payment reminders via text to your customer's phone can help you get invoices paid sooner

Learn the definition of cash flow, why cash flow is important, and what positive and negative cash flow can mean for your business

See key tips to avoid invoice queries from customers, and increase your chance of getting invoices paid on time.

Understand what a credit check is, what it involves, and why they are an important risk assessment tool for your business.

Watch the customer story below from Stephen Paul, Managing Director at Valued Accountancy and user of Chaser's software since 2016.

A game-changer for finance teams and their accountants

Understand how to eliminate manual work in your debtor management process, and reduce late payments from day one

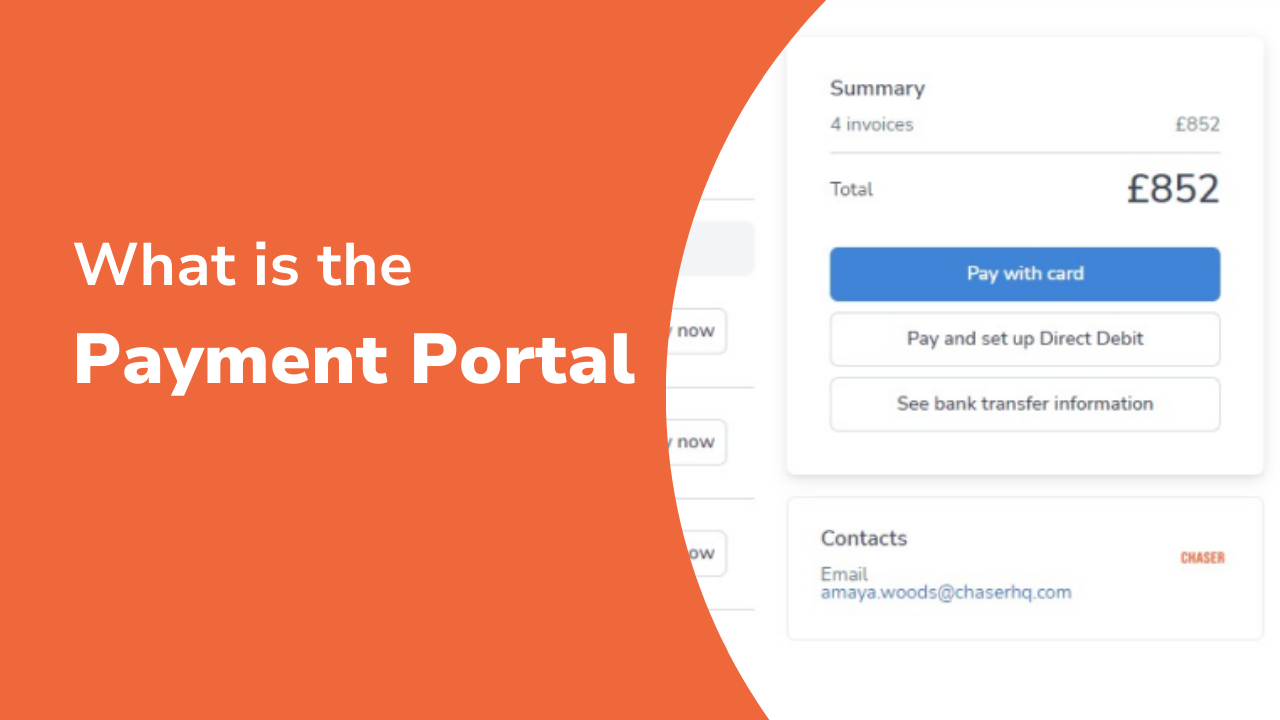

Learn how the Payment Portal works

Learn how you can optimize your accounts receivable process with the help of Chaser and Xero

Understand the importance of aged debtor reports in accounts receivable management

See seven proven strategies that are helping businesses to stop late payments in their tracks, reduce days sales outstanding, and improve cash flow.

5 steps to get your invoices paid faster.

Hear five common reasons why your customer hasn't paid you yet, and how to resolve them

Hear seven top tips to reduce late invoice payments, and increase your chances of getting paid on time.

Hear about three credit control mistakes you could be making at your business, and how to avoid them

Do you have to send invoice follow-ups to remind customers about their invoices due month after month? We’ve got you covered. These 40 templates strike the right balance between being polite and professional, whilst requesting payment promptly and creating a sense of urgency.

Get your invoices paid faster with 20 best practice SMS payment chasing templates, developed by accounts receivables experts. Simply copy and paste these templates which cover every invoice chasing situation and start chasing your invoices via SMS today.

Tried and tested, from our 8 years of invoice chasing experience and having helped businesses chase over $10bn to date. These templates can be copied and pasted directly, for you to send to customers!

Getting invoices paid on time and implementing effective credit control procedures is difficult for businesses these days. Having to deal with multiple invoice queries, or having a customer dispute an invoice adds a whole new dimension of stress and effort to manage your accounts receivables.

Are you tracking the right KPIs for your accounts receivable team's performance? If not, you could be missing out on important insights that could help improve your bottom line.

Approach receivables phone calls in the most effective way possible with the advice and scripts shared in this guide. These scripts have been tried and tested, from our 8 years of invoice chasing experience and having helped businesses chase over $10bn to date.

Written in collaboration with accounting industry leaders, this kitbag offers insights, templates, white papers, processes, conversation starters, and much more to help you save time and scale your firm.

Best-practice guidance on offering payment plans

.jpg)

We’re sharing our guidance on collections for credit controllers! This guide ensures any credit controller is well-equipt on how to avoid bad payers, and what to do when payments stop.

Late paying customers? This guide covers what to do when your customers aren't paying their invoices, written by credit control experts.

Improve your accounts receivables process, avoid common credit control problems and reduce days sales outstanding with this comprehensive policy template.

Struggling with cash flow? You're not alone. 82% of business failures are down to problems with cash flow (US Bank), and 8 out of 10 entrepreneurs who start businesses fail within the first 18 months of trading, with cash flow issues cited as the main reason for failure (Hiscox and Bloomberg).

With stretched finance teams and a challenging economic environment, it's more important than ever to manage your cash flow well. But where should you focus your efforts? Are some areas more important than others? And how can you ensure that you're getting the most out of your cash flow?

Accurately predicting a recession is difficult, but there are certain indicators that can give us a hint as to whether one might be on the horizon. Rising unemployment, lowering consumer confidence, and slowing economic growth are all red flags that a recession might be looming.

The IMF predicts the world economy will contract by 4.9 percent during 2020, and global economies are not expected to recover from the effects of the pandemic until late 2022 (ING).

Recruitment agencies are particularly vulnerable to late payments and poor cash flow due to the nature of the industry. Whether you are a temp agency or a traditional recruitment agency, your client will not make the complete payment upfront and a major chunk of the payment will only be made once a candidate accepts the job or continues a few months into it.